Texas Border Business

By Joey Gomez

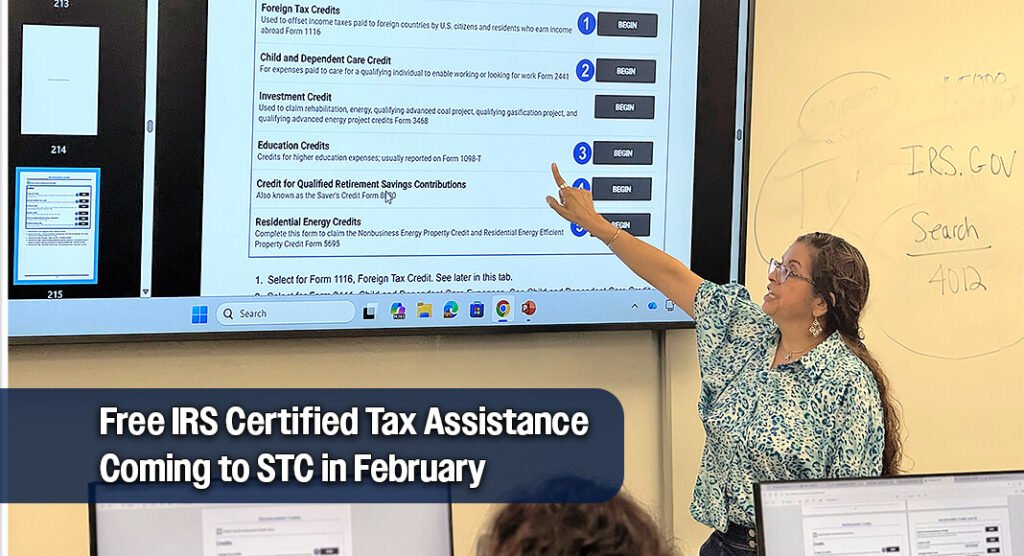

McALLEN, Texas – The Volunteer Income Tax Assistance (VITA) program is returning to South Texas College this February, offering free tax preparation services to qualifying residents across the Rio Grande Valley ahead of the April 15 filing deadline.

VITA offices at STC’s Pecan Campus will open Monday Feb. 2, followed by services at the Mid-Valley Campus beginning Tuesday, Feb. 3. The services at both campuses will run for six weeks, concluding March 12 at Mid-Valley and March 14 at Pecan.

Services at the Pecan Campus will be offered Monday through Thursday from 12 p.m. to 4 p.m. located in Building P, Room 2.140 located at 3201 W. Pecan Blvd. in McAllen.

The Mid-Valley site will operate Tuesdays and Wednesdays from 4 p.m. to 7 p.m. in the Pavilion Building, Room B-202 at 400 N. Border Ave. in Weslaco.

Both sites will be closed Feb. 16 and Feb. 25.

The free services, coordinated through STC’s Business Administration program and administered by United Way of South Texas in partnership with the Internal Revenue Service, provides tax preparation for individuals and families earning $67,000 or less, people with disabilities and taxpayers with limited English proficiency.

“We want to make sure that all our volunteers are prepared for this tax preparation opportunity because not only is it such a wonderful experience for them to get involved, it’s also a great way for them earn valuable knowledge in the field, especially for our Accounting students,” said Anay De Leon, STC Accounting program faculty member and coordinator of VITA services. “Tax preparation is usually very expensive, but we offer our services completely free to the community.”

STC began training volunteers this month, preparing both students and community members to become IRS-certified tax preparers and counselors. De Leon said interest has been strong heading into the 2026 season, with increased outreach and growing student preparation.

This year’s VITA season also brings expanded eligibility and new tax law updates that could benefit more taxpayers.

“There are changes involving overtime income, higher deductions for seniors and new credits for certain vehicle purchases,” De Leon said. “Because of this, we are really preparing our volunteers so we can help the community take full advantage of these benefits.”

The VITA program has served the Rio Grande Valley for more than three decades and has partnered with STC for more than 14 years. Last year alone, VITA at STC filed more than 330 tax returns and generated more than $564,000 in refunds for local residents.

Beyond financial relief, the program offers hands-on learning for students pursuing careers in accounting and business.

“It’s very important for young individuals like our students to have humble beginnings and help others,” De Leon said. “We have volunteers as young as 16 who want to be a part of this, not only to help the community, but to learn how to do their own taxes and gain real-world experience.”

De Leon encouraged residents to schedule appointments early and take advantage of the no-cost services.

“I want to encourage the community to come and stop by. Make an appointment and get their taxes filed,” she said. “Save those $300 or $400 you would normally pay. Keep that money in your pocket and take advantage of this opportunity.”

Appointments are handled through United Way of South Texas. For more information about VITA services at STC visit www.southtexascollege.edu/vita/.

Information source: STC