Texas Border Business

PHARR — Thanks to a partnership between Pharr-San Juan-Alamo ISD (PSJA ISD) and United Way Volunteer Income Tax Assistance (VITA) Program, hundreds of qualifying families in the area will be able to receive free income tax preparation services this tax season thanks to dozens of IRS-certified PSJA ISD student volunteers.

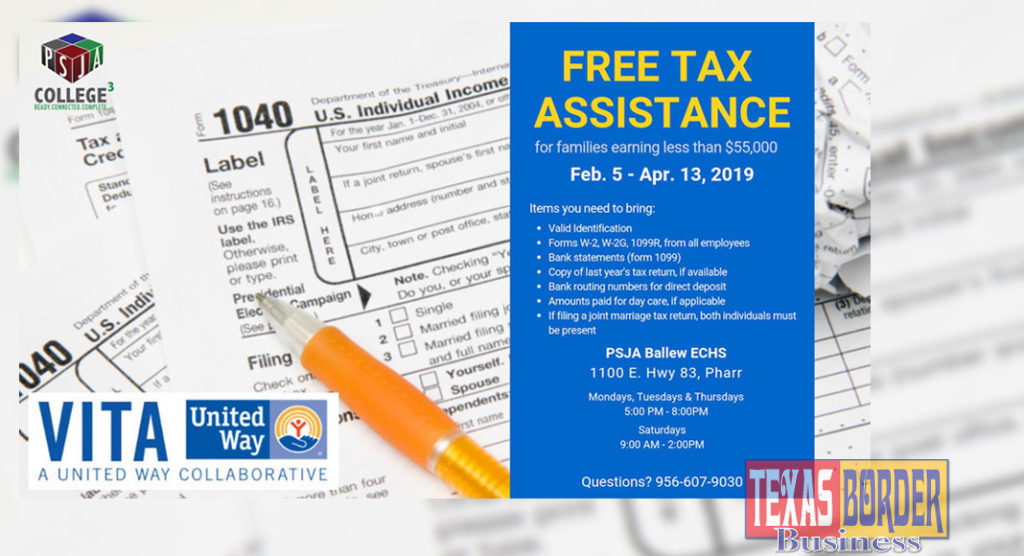

Sponsored by the Internal Revenue Service (IRS), the VITA program offers free assistance to people with a household income of $55,000 or less, persons with disabilities, elderly and limited English-speaking taxpayers. Internal Revenue Service (IRS) certified volunteers provide free basic income tax return preparation with electronic filing to individuals who qualify.

Tax preparation assistance is being provided at PSJA Ballew Early College High School (1100 E. Highway 83 in Pharr) during the following dates and times:

PSJA Ballew Early College High School

Feb.5 – April 13, 2019

Mondays, Tuesdays & Thursdays: 5:00 pm – 8:00 pm

Saturdays: 9:00 am – 2:00 pm

In order to assist at the site, the PSJA ISD student volunteers had to attend training and pass three rigorous exams to earn their IRS certification. Volunteers include students in grades 9-12th from all of the district’s high schools (PSJA ECHS, PSJA North ECHS, PSJA Memorial ECHS, PSJA Southwest ECHS, PSJA T. Jefferson T-STEM ECHS, PSJA Sotomayor ECHS, PSJA Collegiate HS Program, and PSJA Ballew ECHS).

“Our students have sacrificed three of their Saturdays to become VITA certified volunteers,” said the PSJA Ballew Site Coordinator Leticia Bocanegra. “They are doing an awesome job preparing tax returns free of charge for their community. Thanks to their efforts, this community service site is a great success at PSJA!”

Qualifying families must provide a valid Identification and Social Security Cards or Taxpayer Identification Numbers (TIN) for all household members to receive assistance. In addition to the following items, if applicable: Forms W-2, W-2G, 1099-R from all employers; Interest and dividend statements from banks (Form 1099); a copy of last year’s return if available; bank routing numbers and account numbers for direct deposit; total amounts paid for daycare providers and their tax identifying number. If filing a married joint tax return, both spouses must be present to sign the required forms.

For more information on the services offered, you may call 956-607-9030 or send an email to mailto:unitedwayvita9030@gmail.com