Texas Border Business

By Brad Frisby

NAI Rio Grande Valley has launched a project that will provide a quarterly report pertaining to all things multifamily. From student housing, senior living projects, tax credit projects, and everything in between, we have gathered the data and conducted a thorough analysis to uncover the mystery of the rental market in Hidalgo County. Our report covers occupancy levels, the volume of units, the pipeline of under construction and proposed properties, and recent trades.

McAllen MSA Multifamily – State of the Market

The McAllen MSA (Metropolitan Statistics Area) is the fifth-largest MSA in Texas and is expected to reach a population of one million in the 2020 U.S. Census results. The McAllen MSA has over 40,000 rental units in multifamily properties for institutional, local, and out of market investors; all of whom should learn and appreciate the variety of multifamily products and how to realize net gains before taking the plunge.

McAllen and the cities that makeup Hidalgo County are growing at a rapid clip. McAllen’s on-going business-friendly climate has been a model for many of the neighboring cities including Edinburg, Mission, and Pharr and smaller communities of Hidalgo, Alamo, San Juan, Alton, Weslaco, Mercedes, and Donna.

The median age in Hidalgo County (McAllen MSA) is highly populated with a young “30 something” crowd that often lacks buying power to get in the owner-occupied part of the market. Due to this innovative subgroup, conventional apartment communities have popped up like wildfires during the last five years in these cities. Thus, there is a population that remains financially challenged placing importance on rental housing. Furthermore, investments in transportation and education infrastructure are bringing billions of dollars to the Rio Grande Valley. The merger of UT-RGV, the creation of the UT-RGV Medical School, the establishment of Texas A&M University, and the expansion of South Texas College has impacted the landscape of rental housing which is destined for a continuum for growth. Knowledge of the market is imperative for investors.

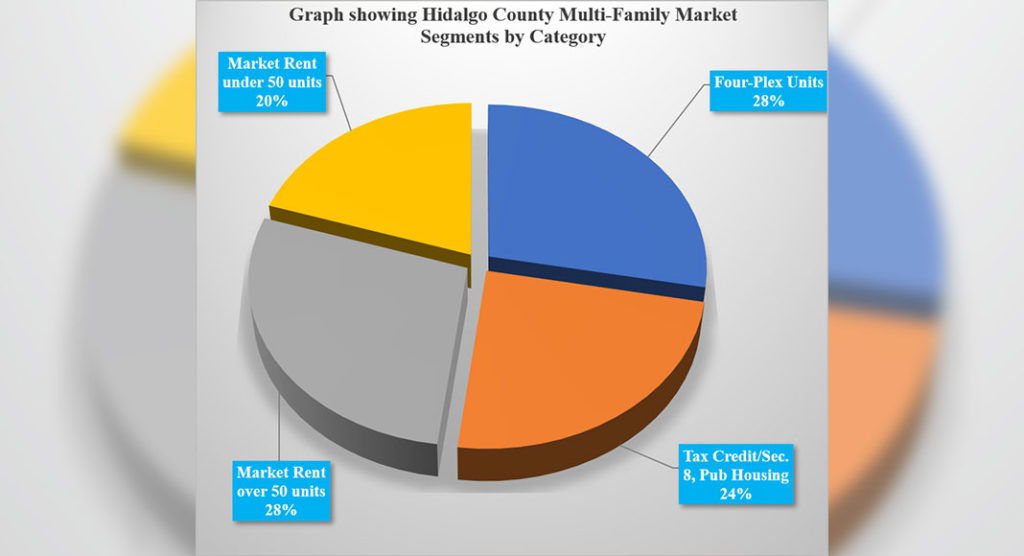

Conventional market-rent apartment properties with 50 units or more make up 28% of the 40,000 units. Overall occupancy is near stable at 92%. Consistent new supply has kept this number hovering just above 90% for the past three years since the market absorbed the record number of new units delivered in 2015 and 2016. Rent growth ranges from 0.5% to 2.5% depending on the location, management, and amenities of each individual property. Recent trades in this arena have shown a large increase in purchase price with a few properties collecting over $100K per door. Age and condition can markedly impact the price per door along with deferred maintenance. Several high-profile properties will trade hands in 2020. Investors looking for value-add opportunities are running up against owners with increased asking prices. We expect approximately 300 units to be built in 2020 within this sub-set.

Unconventional market-rent apartment properties with under 50 units make up 20% of the 40,000 units. This is the trickiest sub-set to analyze. Typically, owners hold these properties long term. Advertising available units on larger platforms are not economical due to the high price of advertising vs. the smaller budget for these properties. Facebook seems to be the go-to place for these owners looking to fill units.

Tax Credit, Section 8, and Public Housing properties make up 24% of the 40,000. Tax credit properties almost always have a percentage mix of market-rate units (10%) and “affordable/low-income” units (90%). Percentage splits can vary. In 2019, 485 units were awarded housing credits by the Texas Department of Housing and Community Affairs, 90 of which are dedicated to elderly persons. The number of housing credits awarded in July of 2020 will be similar. This arena is extremely competitive and awarded on a scoring system based on characteristics corresponding with location, community/municipality support, and financial feasibility. Twenty-two properties with 2,196 units are jockeying to become the next 500 plus or minus units to be awarded for 2020.

Last, but certainly not least, are the Four-Plex specific subdivisions that make up 28% of the overall 40,000 units. Approximately 80 subdivisions have been built or are under construction in the market. These neighborhood subdivisions have anywhere between 10-100 lots totaling approximately 2,770 lots that have been built, and approximately 440 lots which remain unbuilt. This translates to 11,075 units rented or available, and 1,775 unbuilt/potential units; 16% of the current inventory is not built out. These numbers include under construction subdivisions of Union Square and Bel-Air in Edinburg, and a un-named community at the corner of Pecan and Bentsen in McAllen, all three of which have not delivered a built lot at this point.

In the coming months, Multifamily Specialist, Brad Frisby, will add content to this subject matter driving more business to the Hidalgo County market and facilitate sound decision making by investors, lenders, sellers, and developers. Brad has created a 1st Quarter market report which deals with market fundamentals/metrics and recent transactions.

SOURCE: Hidalgo County records, Reonomy, CoStar, and Brad Frisby.