Texas Border Business

SINGAPORE – Wood Mackenzie, a Verisk business (Nasdaq:VRSK), reveals in its latest Accelerated Energy Transition (AET) 1.5-Degree scenario report, that the world needs to double-down on plans to achieve the goal of limiting the rise in global temperatures to within 1.5 degrees Celsius (˚C) by 2050.

Over the last year, strong demand recovery and a lack of investment in supply has caused prices to rise across sectors. Energy security and geopolitical tensions have added unprecedented uncertainty to markets across the globe. On top of that, countries and corporations still bear the massive challenge of limiting global warming to 1.5 ˚C.

David Brown, Head of Markets and Transitions Americas, said: “Record commodity prices and recent geopolitical changes have highlighted the challenges in navigating the energy transition. The world is facing its biggest challenge yet in its journey towards net zero.

“To remain on course, those most exposed to global commodity markets need to double-down on plans to decarbonise through electrification and other emerging, net-zero enabling technologies. Policy must be geared towards renewable growth and investment in grid infrastructure.”

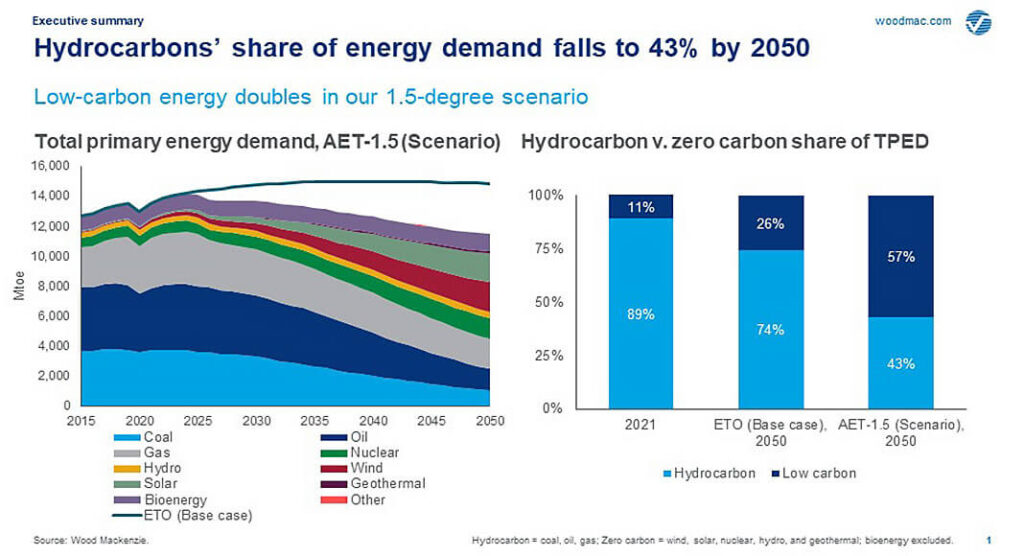

Electrification is expected to dominate, providing 48% of the world’s energy consumption supported by the rapid deployment of wind and solar which will account for 61% of a significantly larger power market globally by 2050. Meanwhile, hydrocarbons’ share of energy demand falls to 43% in 2050 compared to 89% today. Coal and oil demand decline nearly two-thirds during this period. Natural gas is expected to be resilient, falling about 26%, supported by blue hydrogen production and carbon capture and storage (CCS) adoption in the power sector.

Central to the electrification of global economies is road transportation. Global electric vehicle stock is expected to rise to around 1.7 billion vehicles by 2050 in AET-1.5 and will require substantial investment in charging infrastructure which could reach 1 billion units. Battery pack prices will continue to fall as regulatory supports grow and technologies advance. But an unprecedented growth in mine supply is required to deliver the raw materials to underpin electrification of the transport sector. Metals costs will endure vast price cycles as demand booms and higher carbon costs are embedded into production. End-users will need to be cautious about near-term price volatility for battery raw materials caused by supply-demand disconnect or other disruptions.

Advanced nuclear small modular reactors (SMR), bioenergy, geothermal and battery storage also play important roles as the world approaches AET-1.5 towards 2050. These low carbon dispatchable generation become critical due to higher wind and solar penetration.

As mid-century approaches, emerging technologies including CCUS and hydrogen at industrial scale will become critical for decarbonising hard-to-abate sectors. Hydrocarbon resource holders could also monetise remaining reserves through blue hydrogen, and these support CCUS deployment, establishing hubs for power and industry.

Prakash Sharma, Head of Markets and Transitions Asia Pacific, said: “Low-carbon hydrogen and CCUS deliver the last mile on emissions reductions – the solution for difficult-to-abate end-use sectors and for providing reliable, flexible dispatchable generation. Under AET-1.5, we expect the power sector to account for a sizable chunk of low-carbon hydrogen demand. China, US, India and EU-27 are expected to make up 70% of global hydrogen demand by 2050. This means a globally traded hydrogen market of US$475 billion emerges.”

However, to incentivise technology development and adoption, global carbon prices need to rise. The prospects of a global carbon market improved significantly after resolution of Article 6 at the COP26 meeting last year. The momentum is expected to continue, with a global carbon price to take shape by 2030.

Murray Douglas, Research Director, said: “We have expanded our assessment of a global carbon price to deliver global net zero by 2050. The AET-1.5 price represents an average global price required to facilitate and incentivise low emissions technology development and adoption. The price implementation will be closely linked to government economic priorities and the pace of the transition in different markets.”

Wood Mackenzie expects the global carbon price to rise seven-fold from an average of US$25 per tonne (t) of carbon dioxide equivalent (CO2e) today to US$175/t CO2e by 2050 in developed economies and US$127/t CO2e in emerging economies. Some countries will likely choose to integrate international or domestic offsets (nature-based or technological solutions) in compliance mechanisms, to increase flexibility.

While the journey to net zero might seem insurmountable at present, there are boundless opportunities for those willing to take a shot. Around US$60 trillion of capex investment is needed to get to net zero by 2050 in low-carbon technologies and infrastructure, mining commodities and abated fossil fuels.