Texas Border Business

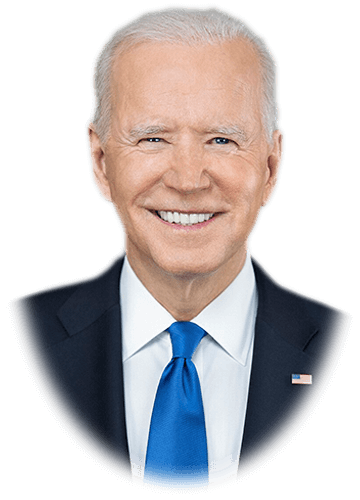

LiftFund founder Janie Barrera was part of a select group of leaders invited to the White House to participate in a roundtable regarding a wide range of new initiatives to expand access to capital for small businesses.

Quote: “LiftFund is proud to be a part of the conversation to make sure programs are as accessible as possible. We know that access to capital transforms not only individual small businesses, but the entire communities that surround them. The initiatives spearheaded by this administration will make some much-needed changes to policies that affect small businesses every day.”

- The Administration will convene a roundtable with leaders across the small business space to discuss its commitment to ensuring small businesses have the access to the capital, technical assistance, and support they need to thrive.

- The Biden-Harris Administration is expanding access to capital and support for small businesses.

- The Census Bureau reported 10.5 million new business applications in 2021-2022, the strongest two years on record.

- The Administration is proposing to lift the moratorium on new 7a lending licenses and open a path for Community Advantage program to become permanent.

- The Administration is proposing a new class of SBIC license and modernizing the SBIC program license offering and process.

- The Administration is proposing to streamline and modernize various regulations governing its 7(a) and 504 loan programs.

- The Treasury Department has implemented the American Rescue Plan’s State Small Business Credit Initiative for $10 billion in funding.

- The Emergency Capital Investment Program has closed and funded $8.38 billion in investments with 170 institutions.

- The CDFI Fund has deployed $5 billion in New Market Tax Credit allocations and $355 million under the Bond Guarantee program.

- The Administration is improving SBA’s Lender Match and the Interagency Community Investment Committee to maximize the impact of federal community investments.

- The Administration is partnering with the CDFI Fund to amplify the impact of existing small business capital access programs.

Follow the link below to see a complete description of the discussion: