Small business owners report high optimism and share insights on managing business seasonality in the Wells Fargo/Gallup Small Business Index.

Texas Border Business

SAN FRANCISCO, Aug. 2, 2017 – Small business optimism continues to climb in the third quarter as business owners said they are the most optimistic in more than a decade, according to findings from the Wells Fargo/Gallup Small Business Index, conducted July 10–14.

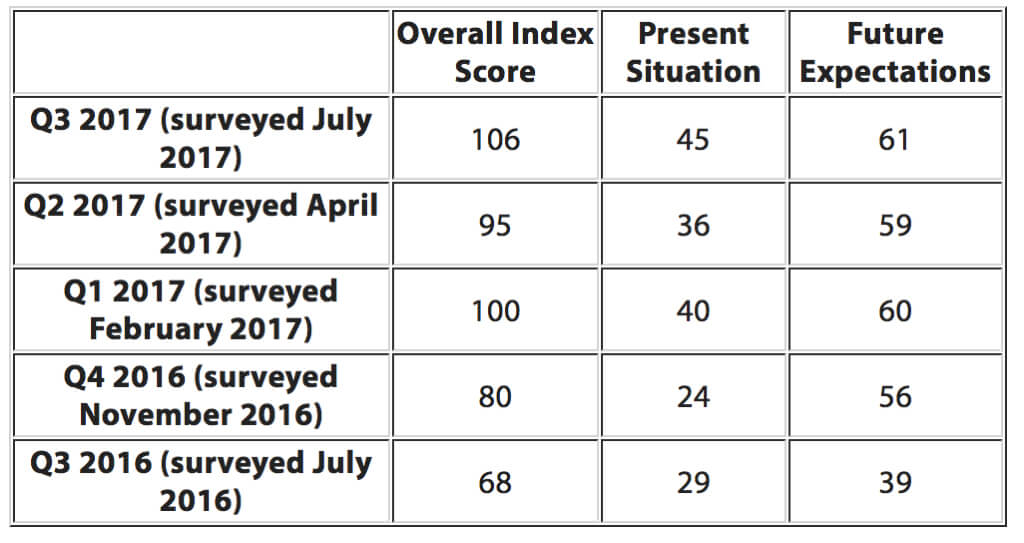

In the quarterly survey, which measures the optimism of small business owners, the overall Index score jumped to 106 in July – an 11-point increase from 95 in April and the highest since 113 in April 2007. The increase in optimism was driven by several factors, including:

- Strong financial situation– Seventy-six percent said their current financial situation is very good or somewhat good, up from 73 percent in April.

- Healthy revenues– For the second quarter in a row, almost half (46 percent) said their business’s revenue increased over the past 12 months, up from 41 percent a year ago.

- Ease of obtaining credit– Nearly half of small business owners (48 percent) said credit will be somewhat easy or very easy to obtain over the next 12 months.

- More hiring– Twenty-one percent said the number of jobs at their company increased over the past 12 months, up from 19 percent in April.

“Our latest survey tells us that small business owners continue to feel confident about their current situation and are optimistic about the future,” said Mark Vitner, Managing Director and Senior Economist, Wells Fargo. “As the economy strengthens, small business owners are reporting improvements in their day-to-day operations, particularly their sales. With their finances in better shape and fewer business owners expressing concern about the regulatory environment, more businesses are planning to boost capital spending and hiring. It’s reassuring to see these improvements, and to see that optimism has returned to its highest level since early-2007.”

Managing business seasonality

In the survey, small business owners were asked about the seasonal cycles that their businesses experience during the year. Forty-five percent reported they have predictable times of the year that are significantly busier or slower than others.

They also were asked how they manage their business operations during the ebb and flow of the seasons. To offset the slow months, 62 percent said they reduce their capital expenditures, and 43 percent said they reduce hours for their employees. Thirty-nine percent cut back their own personal hours of work. During busier times most business owners (77 percent) said they increase the number of hours they personally work, more than half (55 percent) increase their employee’s hours, and 40 percent hire new seasonal or part-time employees.

When it comes to handling business finances throughout the year, 41 percent of business owners said seasonal differences make it more difficult to manage cash flow. During slower times of the year, one in five (21 percent) reported increasing their use of business lines of credit or business credit cards to bridge cash flow gaps. During busier times, two-thirds (64 percent) said they pay down debt or reduce their use of credit.

Small business challenges

When business owners were asked to identify the most important challenge facing their business today, hiring and retaining quality staff was at the top of the list, at 13 percent. This was followed by attracting customers and finding new business (12 percent); taxes, government regulations and financial stability/cash flow (9 percent); there was a decline in mentions of the overall economy (5 percent), down from 10 percent in April.

Small Business Index key drivers

In July, the “present situation” score – how business owners gauge their perceptions over the past 12 months – jumped to 45, up from 36 in April and marking the highest point since April 2007. The “future expectations” score – how business owners expect their businesses to perform over the next 12 months – rose two points to 61, also the highest since April 2007.