Texas Border Business

Texas Border Business

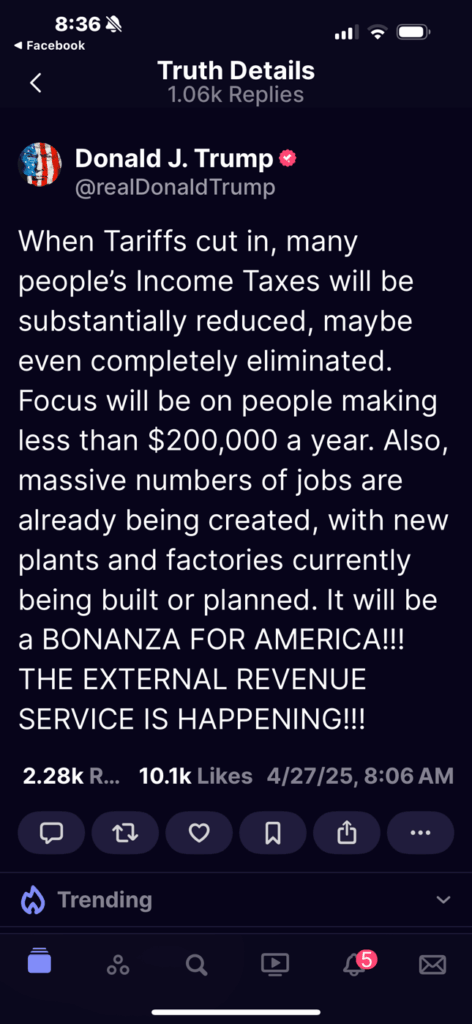

On April 27, 2025, President Donald J. Trump took to TRUTH Social to share new details about his economic vision for the country, emphasizing the role tariffs could play in reshaping America’s tax structure and job market.

In his post, Trump stated that as new tariffs are implemented, “many people’s Income Taxes will be substantially reduced, maybe even completely eliminated.” He clarified that the intended beneficiaries would be Americans earning less than $200,000 annually. Trump framed the plan as a major shift in federal revenue generation, suggesting that tariff income from foreign goods could replace or dramatically reduce the need for traditional income taxes for a large population segment.

Trump also highlighted that “massive numbers of jobs are already being created,” attributing the growth to “new plants and factories currently being built or planned.” He referred to this projected expansion as a “BONANZA FOR AMERICA,” signaling optimism about the economic future under his proposals.

In addition to discussing tariffs and job creation, Trump introduced a new term, stating, “THE EXTERNAL REVENUE SERVICE IS HAPPENING.” While he did not elaborate in the post, the phrase appears to reflect his concept of shifting the burden of government funding from domestic income taxes to external sources—specifically through tariffs on imported goods.

The former president’s approach aligns with longstanding views he has expressed on trade and taxation, favoring protective tariffs to boost domestic manufacturing and lessen America’s reliance on tax revenue from individuals. If enacted, the plan would mark a significant departure from the traditional American tax model, which has been based primarily on individual and corporate income taxes for over a century.

Currently, no formal legislative proposals are associated with the specific policy changes Trump described in his post. The president or his team would need to provide further clarification to understand how such a system would be structured, how it would affect government revenue streams, and how it would comply with existing trade agreements and tax laws.

“When Tariffs cut in, many people’s Income Taxes will be substantially reduced, maybe even completely eliminated. Focus will be on people making less than $200,000 a year. Also, massive numbers of jobs are already being created, with new plants and factories currently being built or planned. It will be a BONANZA FOR AMERICA!!! THE EXTERNAL REVENUE SERVICE IS HAPPENING!!!,” Donald J. Trump