Texas Border Business

U.S. Chamber of Commerce

By Thaddeus Swanek / Senior Writer and Editor, Strategic Communications, U.S. Chamber of Commerce

The MetLife & U.S. Chamber of Commerce Small Business Index for Q1 2024 surveyed respondents about future threats and crisis planning. The survey includes compelling findings on how small businesses perceive—and plan to respond to—those threats.

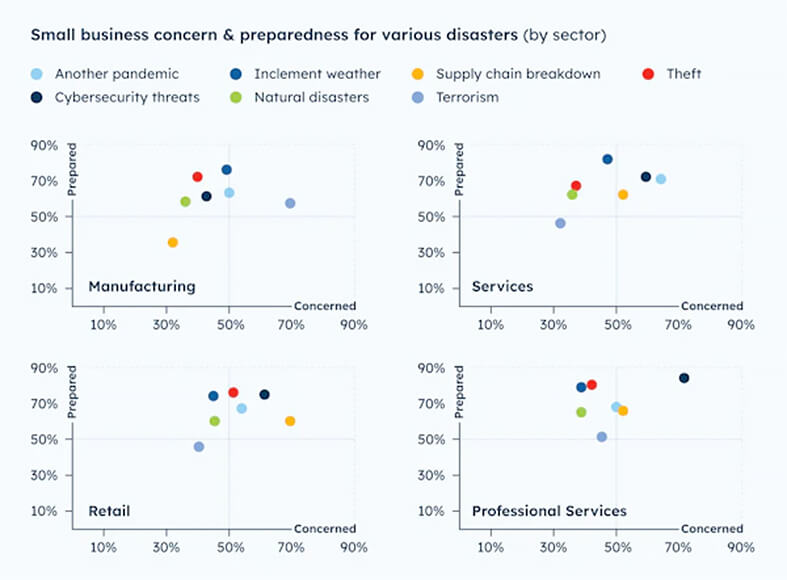

Small businesses say cybersecurity attacks are the threat they’re most concerned about—but supply chain disruptions and another pandemic round out the top three perceived threats.

A majority (60%) of small businesses say cybersecurity threats, including phishing, malware, and ransomware, are a top concern. A majority also say supply chain breakdowns (58%) and another pandemic (54%) are top concerns. Less than half of small businesses say they are concerned about inclement weather (45%), theft (42%), natural disasters (39%), or an act of terrorism (37%).

However, most small businesses say they are prepared to respond to an array of threats and disasters. Three in four small businesses say they are prepared to handle inclement weather (77%), theft (74%), or cybersecurity threats (73%). Fewer, but still a majority, say they are prepared to handle another pandemic (67%), natural disasters (61%), or a supply chain breakdown (61%).

How Small Businesses Are Preparing for Threats

Small businesses are taking various measures to address a range of potential threats, such as training staff, bolstering their supply chains, building up rainy-day funds, and others.

For example, roughly half of small businesses say they have trained staff on cybersecurity measures (48%) in the past year, levels that are highest among the professional services industry (64%) and among businesses with between 20 and 500 employees (69%).

Small businesses have also bolstered their rainy-day funds over the past year: Roughly three in five small businesses report contributing to (62%) or establishing (62%) a rainy-day fund to prepare for a crisis or threat.

A majority of small businesses (61%) also feel comfortable that said rainy-day funds would be able to help with unexpected issues. This represents an eight-point increase since 2018, when 53% of businesses felt comfortable with their rainy-day fund.

Overall, a minority (around two in five) of small businesses say they have established a formalized plan for threats (43%) or taken out insurance in case of natural disasters (38%).

Small Businesses Build Redundancy into Supply Chains

Small businesses also report assessing their supply chain’s resiliency.

To counter supply chain threats, one in three (35%) small businesses report building out their supply chain in the last year. Among the businesses that have built out existing supply chains in the past year, the most popular measures include strengthening relationships with suppliers (53%) or seeking out additional suppliers (48%).

Fewer say they have used technology to streamline their supply chain (32%) or used demand planning or forecasting to optimize inventory on hand (25%).

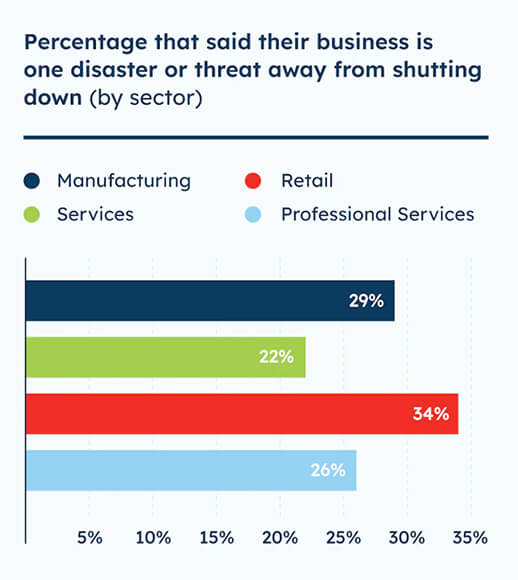

One Crisis Away from Shutting Down

Despite all this preparation, a small but significant minority of small businesses said they are one crisis away from closure.

One in four (27%) small businesses say they are one disaster or threat away from shutting down. This is especially true for businesses owned by Gen Zers or millennials (34%) and businesses in operation for ten years or less (33%). By sector, retailers (34%) are more likely to say they’re one disaster from shutting down than the services sector, where only 22% say the same.

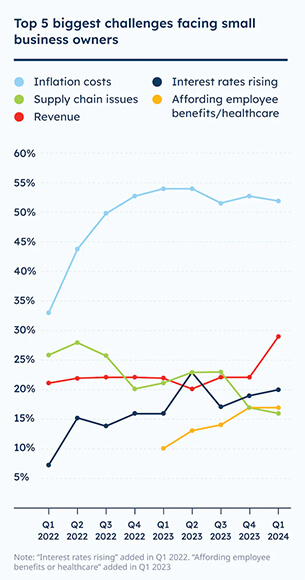

Inflation Remains a Concern

In terms of current challenges, inflation remains near the top of the list.

In fact, it is the seventh consecutive quarter that over half (52%) of small businesses cite inflation as their main issue. Small businesses report inflation costs as their top issue regardless of business size, sector, and region.

Other concerns don’t come close to inflation, but revenue worries, in particular, crept up this quarter. Small businesses are now more likely to say that revenue is their biggest challenge (29% now vs. 22% last quarter). This brings concerns around revenue back to levels last seen in late 2021.

This quarter, the MetLife & U.S. Chamber of Commerce Small Business Index is 62.3—similar to last quarter’s score of 61.3—reflecting a stable business climate.

The Q1 2024 SBI survey was conducted between January 26 and February 12, 2024. For more findings from this quarter and browse years of small business data, visit the Small Business Index homepage.