Texas Border Business

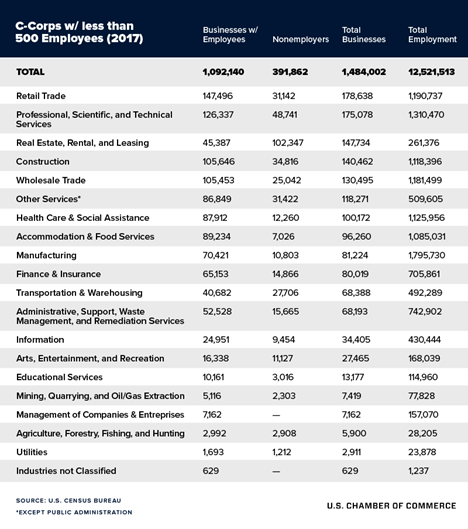

Proposed tax increases will hurt both big businesses and small businesses alike, explains Chamber Senior Economist Curtis Dubay in a blog post. In fact, 1.4 million American small businesses (organized as C-Corporations), employing almost 13 million Americans, would see higher tax rates.

Hardest hit: Manufacturing small business C-Corps employ the most workers out of the group (1.8 million workers). Professional, scientific, and technical services are next (employing 1.3 million), followed by retail (employing 1.2 million).

Why it matters: Tax increases would put U.S. businesses (large and small) at a severe competitive disadvantage with counterparts across the globe and add another burden as many of these small businesses are just now beginning to return to normalcy.

“We have already started a hiring freeze. Between the tax increase, and what we see as a tough regulatory environment, we have to prepare,” said Michael Canty, President of Ohio-based Alloy Precision Technologies, a manufacturing company that employs roughly 85 people and is structured as a C-Corp under the federal tax code.

Big picture: Higher rates on over a million small businesses would suppress wage growth and job creation for American workers at a time when we need to strengthen the middle class and create more higher-paying jobs here at home.

Source: U. S. Chamber of Commerce