Texas Border Business

CORPUS CHRISTI, Texas – For several weeks, Justin Crossie, regional administrator, Region 6, has been on the road meeting with small business owners and lenders throughout the South-Central Region (Louisiana, Arkansas, Oklahoma, New Mexico, and Texas). His goal is to learn first-hand the successes and challenges of the Paycheck Protection Program.

Stopping in Corpus Christi, Texas, he learned like other U.S. cities, small business owners are fighting to keep the local economy healthy and moving forward in the face of COVID-19 setbacks. The pandemic poses an economic threat like nothing else since the Great Depression.

Justin Crossie visited the favorite local restaurant Chops & Eggs owned by brothers Jordan and Ramzi Jaradat while in Corpus Christi.

“One of the best parts of my job is to meet with entrepreneurs, like Jordan and Ramzi, living out their American dream,” Crossie said. “They really are the fabric of America. I can see they are not going to let this pandemic be the ruin of their business.”

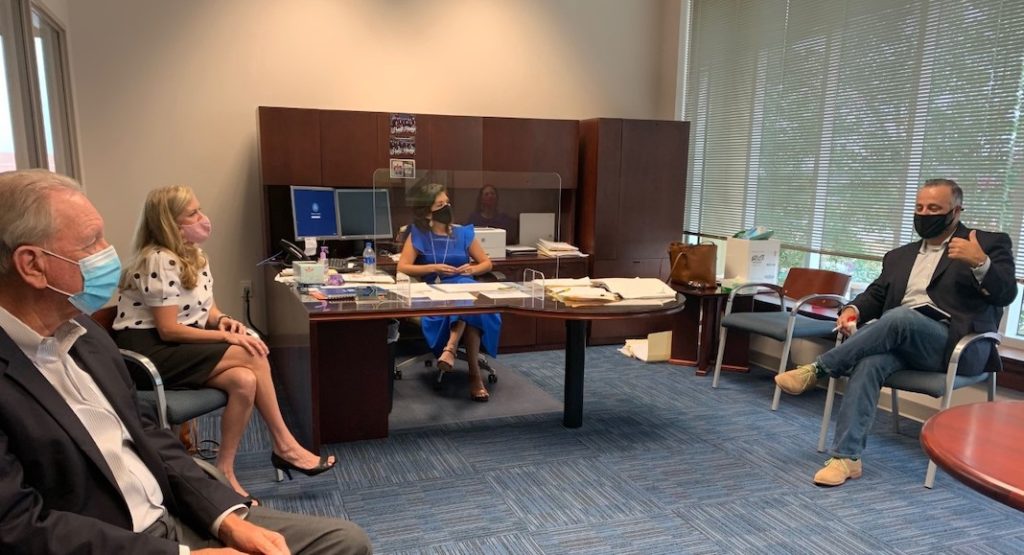

Crossie also visited with Navy Army Community Credit Union. Crossie thanked them for their support of small businesses and their participation in the Paycheck Protection Program. Navy Army Community Credit Union processed more than 400 PPP loans totaling more than $13M, making them the highest producing credit union in the Lower Rio Grande Valley District.

The President, the U.S. Small Business Administration, Treasury, and Congress acted quickly to pump $659 billion in Paycheck Protection Program (PPP) loans to rescue American small businesses and nonprofit organizations. With a funding level nearly equal to the U.S. Department of Defense budget, millions of borrowers have been able to ride out the storm and creatively map out new directions for their business.

SBA began offering PPP loans in the last week of March, just seven days after the President signed the CARES Act into law. By August 8, when the authorization ended, the small Agency pushed out more loans in 5 months than it had in its entire history. It was a monumental task.

Nationally, the PPP program reached across geographic locations, economic regions, rural and underserved communities, and industries. SBA’s strong partnership with nearly 5,500 lenders aided in this extraordinary feat.

In Corpus Christi, SBA approved more than 4,250 PPP loans for small businesses and nonprofits, allowing owners to pay bills and keep an estimated 50,000 local employees on the payroll.

“Without help from the PPP, we would not have been able to stay open,” Jordan Jaradat, owner of Chops & Eggs said.