Texas Border Business

By DAVID A. DÍAZ

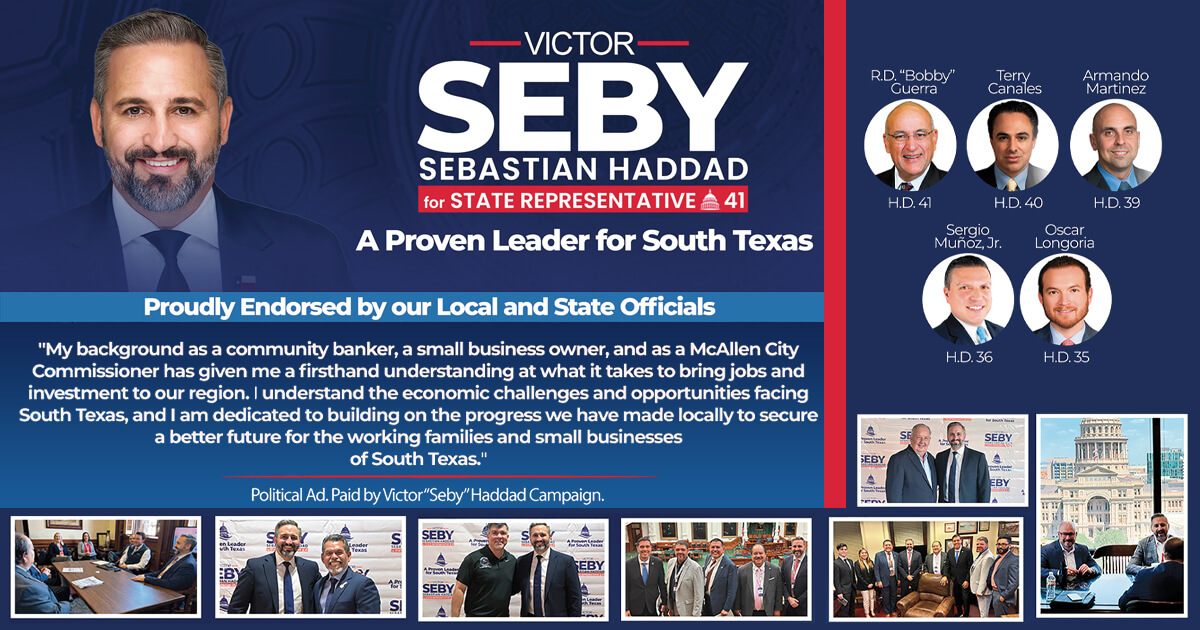

The Texas Property Tax Reform and Transparency Act of 2019, which was signed into law on Wednesday, June 12, 2019, by Gov. Greg Abbott, “returns power to the people” says Rep. Terry Canales, D-Edinburg, who attended the bill-signing ceremony in Austin, and was one of the 10 state lawmaker who shaped the final version of the legislation, which is an historic and sweeping measure that includes restraining increases in local property taxes on homes and businesses.

“During our efforts to pass this proposal, we in the Texas Legislature received constant pressure to leave things as they were, to continue allowing politicians and bureaucrats the power to raise property tax rates – which increases property taxes – without a vote by the people,” Canales said. “Well, I told them I represent the people, and together, the people and the Legislature were going to fix a broken system that has for too long allowed rogue governments, through uncontrolled tax increases, to take away the American Dream of owning and keeping a home.”

Canales was called “a bold, visionary, and courageous leader” by the Speaker of the House Dennis Bonnen, R-Angleton, for his performances on many key legislative priorities, such as the Texas Property Tax Reform and Transparency Act of 2019.

Senate Bill 2, the legislation named the Texas Property Texas Reform and Transparency Act of 2019, was authored by Sen. Paul Bettencourt, R-Houston, Chair of the Senate Committee on Property Tax, and sponsored by Rep. Dustin Burrows, R-Lubbock, Chair of the House Ways and Means Committee.

Canales, Chair of the House Committee on Transportation, was a cosponsor of SB 2.

The author is the legislator who files a bill and guides it through the legislative process (also called the primary author). The sponsor is the legislator who guides a bill through the legislative process after the bill has passed the originating chamber. The sponsor is a member of the opposite chamber of the one in which the bill was filed.

The cosponsor is a legislator who joins with the primary sponsor to guide a bill or resolution through the legislative process in the opposite chamber. A cosponsor must be a member of the opposite chamber from the one in which the measure was filed.

“We made it clear from the outset of this session that our goal was not to simply mask the problem of skyrocketing property taxes, but to make transformative changes that would provide meaningful and lasting reform,” said Abbott. “Because of the work by legislators this session, we are ensuring that Texas remains the best state in the nation to live, work, start a business, and raise a family. By signing Senate Bill 2 into law, we are making tremendous strides to provide long-awaited relief to Texas homeowners and businesses.”

The governor hosted the bill signing at Wally’s Burger Express in Austin, a family-owned business founded in 1980 that has been struggling due to skyrocketing property taxes. Just this year, Wally’s property taxes increased 44 percent, Abbott said.

In addition to Canales’ presence at the bill signing ceremony, Abbott was joined by Robert Mayfield, the owner of Wally’s Burger Express, Lt. Gov. Dan Patrick, R-Houston, Speaker of the House Dennis Bonnen, R-Angleton; Rep. Dustin Burrows, R-Lubbock, Rep. John Zerwas, R-Richmond, Sen. Kelly Hancock, R-North Richland Hills, Sen. Dawn Buckingham, R-Lakeway Hills, and Sen. Charles Perry, R-Lubbock.

Canales said he was the first Democrat to publicly sign up as a supporter of Texas Property Tax Reform and Transparency Act of 2019, but other Democrats later voted for it, including the Rio Grande Valley state legislative delegation in the House and in the Senate.

According to Abbott:

• Senate Bill 2 lowers the property tax rollback rate to 3.5% for cities and counties. Any increase to this rollback rate in cities, counties, and some special districts will require voter approval and automatically trigger a tax ratification election. This rollback rate will be renamed the voter approval tax rate going forward; and

• SB 2 also requires taxing units to post their budgets, tax rates, and tax rate calculation worksheets online. The bill makes numerous improvements to the appraisal and protest process, such as prohibiting an Appraisal Review Board (ARB) from increasing the value of a taxpayer property above its initial value, increasing training requirements for ARB members and arbitrators, and entitling taxpayers to the evidence the appraisal district plans to present at their ARB hearing free of charge.

Among its many key advances, SB 2 provides the first change in the rollback rate in 38 years by lowering it from 8 percent to 3.5 percent for cities and counties. This means as appraised values go up, property tax rates must come down, according to Bettencourt.

Tax Code sec. 26.07 allows voters to petition for an election to repeal a tax rate adopted by a taxing unit that exceeds the unit’s rollback tax rate, according to the House Research Organization, which is the nonpartisan research arm of the Texas House of Representatives. A petition for a rollback election must be signed by a certain percentage of the taxing unit’s registered voters and be submitted to the governing body of the taxing unit within 90 days of the tax rate’s adoption.

In general, the property tax tax is a real estate ad-valorem tax, calculated by a local government, which is paid by the owner of the property. The tax is usually based on the value of the owned property, including land.

Also, SB 2 has an estimated $930 million dollars of taxpayer savings in fiscal year 2024 alone, and is part of a larger package of reform legislation, House Bill 3, that includes an additional $5 billion for property tax relief, but also major changes to the Texas school finance system.

“This is a journey that I started on with Lt. Gov. Dan Patrick, and 300 other taxpayers when we came to the Texas Capitol in 2003 as constituents to ask for property relief,” said Bettencourt. “It’s the first major property tax reform in nearly four decades, and that says it all. As JFK (former President John F. Kennedy) said, ‘Victory has 1,000 fathers, while defeat is an orphan.’”

Canales, who also serves as Chair, House Committee on Transportation, congratulated Bettencourt and Burrows on their leadership roles on behalf of property tax reform and open government associated with SB 2.

“I appreciate Sen. Bettencourt’s reference to the 1960s by quoting President Kennedy, a Democrat and one of the greatest presidents in our nation’s history,” Canales said. “To borrow another famous saying from that epic decade of the 1960s, Senate Bill 2 also returns ‘power to the people.’”

The legislation will improve the transparency and efficiency of the property tax system by providing taxpayers with real-time access to tax information, revising required notices, using easier-to-understand terminology, and making the process generally more taxpayer

The House District 40 state representative’s growing influence in the Texas Legislature has continued to make its presence known during the 86th Texas Legislature in many ways, including being appointed by Speaker of the House Dennis Bonnen, R-Angleton, on Friday, May 10, 2019, to the 10-member Conference Committee on Senate Bill 2.

“I am honored to have been selected by Speaker Bonnen to serve on the House Conference Committee to SB 2, the property tax reform bill,” said Canales. “Like many of my constituents, I am frustrated by ever-rising property taxes. The property tax system is needlessly confusing, and there is real fear from my constituents that they won’t be able to pay next year’s bill.”

The high-powered group of five senators (including Sen. Juan “Chuy” Hinojosa, D-McAllen) and five state representatives (Canales and Rep. Ryan Guillén, D-Rio Grande City), were empowered by Patrick and Bonnen to come up with a final version of SB 2 for action by the full 181-member Texas Legislature.

A conference committee is a committee composed of five members from each chamber appointed by the respective presiding officers to resolve the differences between the house and senate versions of a measure when the originating chamber refuses to concur in the changes made by the opposite chamber.

“It is imperative that the House and Senate work together to address the issue of rising property tax values by balancing the needs of our local governments, with the ability of Texans to afford their ever-increasing property tax appraisals,” Canales added.

He was also selected earlier this year by Bonnen to serve as Chair, House Committee on Transportation, which has substantial power over the fate of highways, airways, waterways, and railways vital to economic prosperity and safety in the Lone Star State.

Canales also made Texas legislative history by becoming the first Mexican American to become Chair, House Committee on Transportation, which also has jurisdiction over governmental entities, including the Texas Department of Motor Vehicles, the Texas Department of Transportation, and the Texas Transportation Commission, which administer and distribute billions of dollars every two years for projects statewide.

Property tax reform is one of the most high-profile issues during the 86th Texas Legislature, which ended its 140-day regular session on Monday, May 27, 2019.

Also according to the Texas Comptroller of Public Accounts:

The Texas local property tax is just that — a local tax, assessed locally, collected locally and used locally.

More than 4,100 local governments in Texas — school districts, cities, counties and various special districts — collect and spend these taxes.

Several types of local governments may tax your property. Texas counties and local school districts tax all nonexempt property within their jurisdictions. You also may pay property taxes to a city and to special districts such as hospital, junior college or water districts.

The governing body of each of these local governments determines the amount of property taxes it wants to raise and sets its own tax rate. Many, but not all, local governments other than counties contract with their county’s tax assessor-collector to collect the tax on their behalf.

Abbott, Patrick, and Bonnen had made property tax reform one of their top priorities for the regular session.

In Dallas, the average property tax bill now exceeds $5,000 and Houston is right behind them, also according to Betancourt.

“Throughout the state, home and business owners were being crushed by property taxes which can grow two to three times faster than their income rise,” said Betancourt. “This is not a partisan issue because it is an everybody pays issue. This reform keeps the dream of home and business ownership alive not just for the Texans who are but also the Texans that are yet to be.”