Texas Border Business

By Pamela Kaur

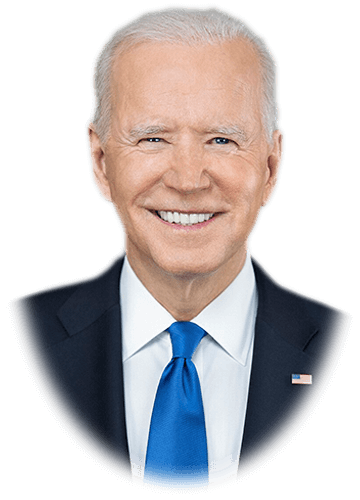

Assistant District Director and SCORE Mentor

There are several, but the key one, in my opinion, is that 80% of business leaders are still predicting a recession. Yes, they’re predicting it will be shallow, but the duration is predicted as 6-12 months.

What this does is create a feedback loop for confirmation bias. Folks read these predictions, and decide to cut their discretionary spending. And the poor have no choice but to cut their spending as they’ve been impacted by inflation.

We are a consumer driven economy, a decrease in goods and services sold results in lower earnings, resulting in companies lowering their earning forecasts. Lowered earning forecasts impacts stock prices, which impacts investment and retirement accounts, resulting in lowered spending. The cycle of consumer spending.

There is also the compression factor in certain market segments. Low-level and repetitive business processes are becoming AI-led leading to layoffs among tech and finance companies. The numbers in of themselves are not large, but they do have a psychological impact on spending.

All of this has a trickle-down effect on small businesses. Our current economic environment does not support a “business as usual” approach.

So what should businesses do? Like their consumers, they must carefully manage their cash flow.

Supply chains are just getting back to normal, but increased costs of materials and labor due to inflation, has resulted in companies maintaining lower inventories and re-adjusting prices.

News is not all bad. A historic number of small businesses were created in 2022 and are being created. But caution is key for the aspiring entrepreneur.

Access to capital has become more difficult. Lending standards have tightened, and the cost of borrowing has significantly increased.

Reduced access to capital not only limits small business expansion, but also their ability to meet current obligations to suppliers. This, in addition to the rise in labor costs results in profit compression.

There is also a trend shift from goods to services. Whether this is temporary or longer lasting, is currently unknown.

My recommendation is that businesses follow an organic path to growth rather than a borrowing fueled approach. The latter is much more risky in today’s economy and may potentially lead to business failure. A conservative approach to cash flow management will lead to business success.

Pamela Kaur is an Assistant District Director and SCORE Mentor, and in her real life, leads business turn-arounds and strategy for a hedge fund. She can be reached at pamela.kaur@scorevolunteer.org

SCORE, an arm of the SBA (Small Business Administration), provides free workshops and mentoring for small businesses. If you have any questions about your business – funding, cash flow, budgeting, employees retention, marketing etc please email us.