Texas Border Business

Texas Border Business

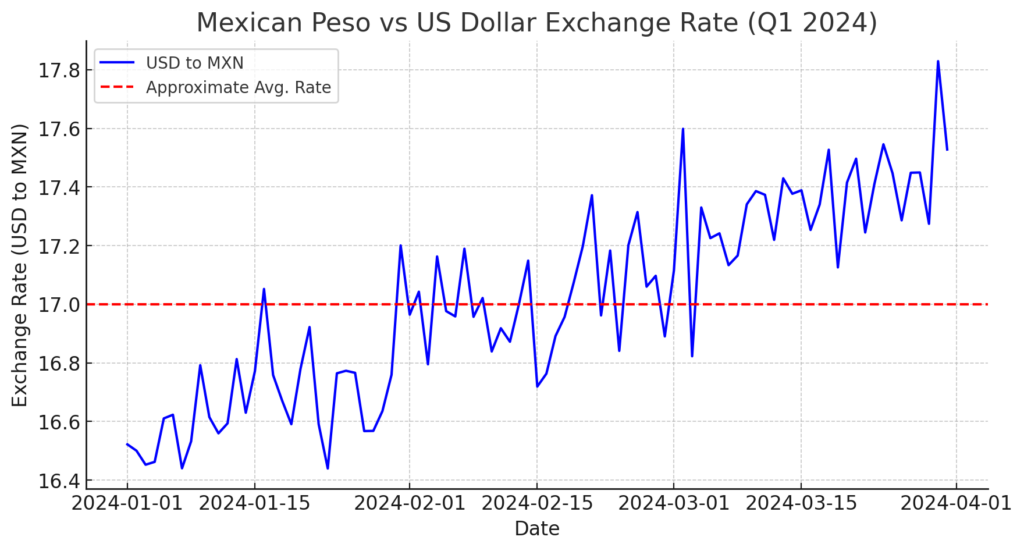

The Mexican peso experienced a notable decline against the US dollar, falling to a low of 17.08 from a recent high of 16.30, marking a 4.6% depreciation in just over a week. As of this week in April 2024, the peso slightly recovered to 17.00 by midday but still showed a significant daily loss of 2.1% from the previous close of 16.72.

This recent slide in the peso’s value appears linked to increasing global financial uncertainty. According to Janneth Quiroz, director of analysis at Monex Financial Group, the decline was triggered by a rise in dislike for international risk, driven by geopolitical tensions. Investors are agitated over the situation between Israel and Iran, with markets reacting to the anticipation of Israel’s response to Iranian actions. https://twitter.com/Janneth_QuirozZ/status/1780232236639334652

Further adding to the peso’s volatility, the DXY index, which tracks the US dollar against a basket of major currencies, showed a slight increase. This change often indicates a stronger investor preference for safer assets, typically benefiting the dollar.

Market participants also closely monitored the United States Federal Reserve. In a recent policy forum, Fed Chair Jerome Powell indicated that despite the strong US economy, inflation levels still needed to align with the Fed’s 2% target. Powell’s comments suggested that the US might maintain its current interest rates, diminishing hopes for a rate cut that could have relieved some pressure on emerging market currencies like the peso.

Previously, the peso had enjoyed a robust position, strengthened by a significant differential in interest rates between the Bank of Mexico and the Federal Reserve. This gap provided an attractive yield to investors, coupled with strong inflows from remittances and foreign investments, driving the peso to its most substantial level nearly nine years earlier in April.

However, Gabriela Siller, director of economic analysis at Banco Base, noted a reversal of fortunes as the peso’s year-to-date gains were wiped out, with the exchange rate climbing back over 17. This shift underscores the fragile nature of emerging market currencies in a volatile global economic landscape, where geopolitical tensions and policy uncertainty in major economies can lead to swift changes in investor sentiment and currency values. https://twitter.com/GabySillerP/status/1780254736307847515

Here’s a chart showing the simulated exchange rate of the Mexican Peso against the US Dollar for the first quarter of 2024. The red dashed line indicates an approximate average rate across the period, visually referencing the currency’s fluctuations during these months. TBB

From the beginning of 2024 to April, the Mexican peso has experienced notable stability and appreciation against the US dollar, continuing its strong performance in 2023. Throughout 2023, the peso strengthened significantly, ending the year at 16.92 MXN per USD, compared to 19.47 MXN per USD at the end of 2022. This marked a 15% gain over the year. The average exchange rate for 2023 was 17.74 MXN per USD, the most substantial level since 2015 (Mexperience | Experience More of Mexico (https://www.mexperience.com/mexicos-peso-more-big-strides-in-23-estimates-for-2024/)).

Several factors contributed to this performance, including high local interest rates, robust economic growth, and substantial remittances from abroad. Specifically, the Bank of Mexico raised its reference interest rate to 11.25% by March 2023 and maintained it throughout the year, which made the peso more attractive to investors seeking higher yields. The country’s GDP growth for 2023 exceeded initial expectations, with a significant boost from exports, tourism, and foreign and domestic investments (Mexperience | Experience More of Mexico (https://www.mexperience.com/mexicos-peso-more-big-strides-in-23-estimates-for-2024/)).

Moreover, the Mexican peso outperformed many other emerging market currencies, benefiting from a favorable interest rate differential relative to the US and strong macroeconomic fundamentals.

The real policy rate differential between Mexico and the US was desirable for carry trade investors, providing a substantial real return and supporting the peso’s value (Dallas Fed (https://www.dallasfed.org/research/economics/2023/0926)).

As of the first quarter of 2024, the peso showed resilience, maintaining levels close to those seen at the end of 2023. Analyst forecasts and market sentiment suggest that the peso might experience some fluctuation but is expected to remain relatively stable in the near term, supported by Mexico’s ongoing economic policies and the global economic environment

(Mexperience | Experience More of Mexico (https://www.mexperience.com/mexicos-peso-more-big-strides-in-23-estimates-for-2024/)