Texas Border Business

US Department of Justice

HOUSTON, Texas – A 56-year-old Houston resident has been found guilty on multiple counts related to a complicated tax fraud scheme, announced U.S. Attorney Alamdar S. Hamdani.

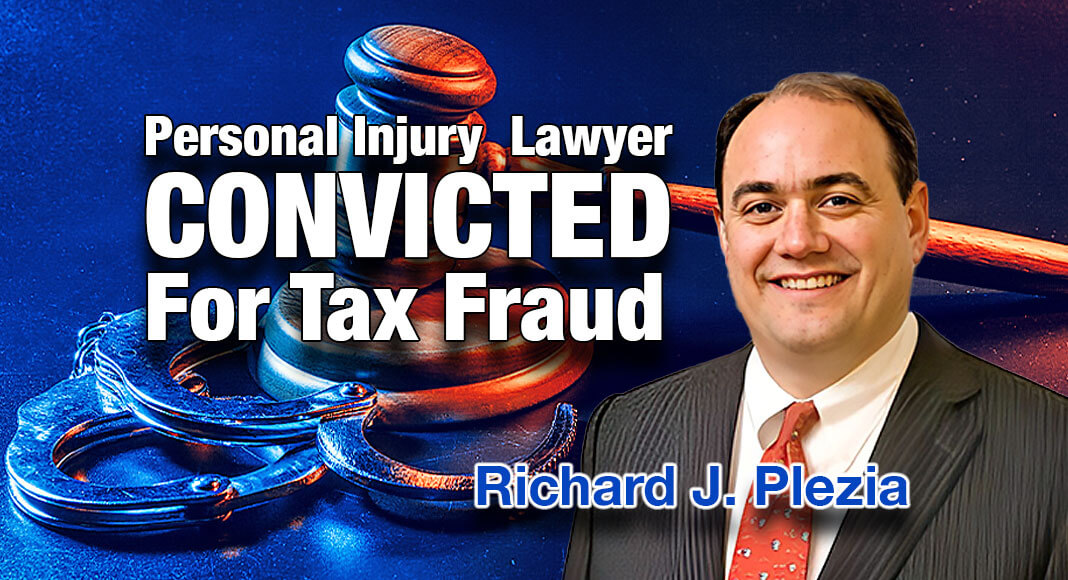

A federal jury convicted Richard J. Plezia for conspiracy as well as two counts of making false statements and falsification of a record following a month-long trial and approximately eight hours of deliberation.

“We are a nation of laws, where lawyers swear to uphold those laws” said Hamdani. “When lawyers, like Plezia, corrupt their oath for their own gain, such actions can corrode the public’s confidence in our legal system. It is important to deter such conduct, and we are pleased with the jury’s verdict holding Plezia accountable for his crimes.”

“I can tell you that justice was served and the professionalism of our special agents from the start of the case to the testimony during the trial is a testament to the outstanding work IRS-Criminal Investigation (CI) does to bring conspiracies like this to finality,” said Special Agent-in-Charge Ramsey E. Covington of IRS-CI’s Houston Field Office. “We are here to serve our community by working with the United States Attorney’s Office to bring criminal activities, specifically those with tax and financial ties, to an end.”

The evidence detailed a complex tax fraud scheme in which Plezia funneled approximately $500,000 through his business account from attorney Jeffrey Stern. The money was given to case runner Marcus Esquivel, from whom Stern was illegally purchasing personal injury cases.

Separately, Plezia himself was illegally buying cases from Esquivel and another case runner. On his tax returns, Stern took illegal tax deductions for his payments to various runners including Esquivel. This caused approximately $4.3 million in tax loss to the IRS. Plezia filed false returns, incorrectly claiming the pass-through payments from Stern through Plezia to Esquivel as income and taking corresponding incorrect deductions for marketing and advertising.

In 2016, Plezia lied to authorities, claiming he had not paid Esquivel for case referrals. Two years later, he again lied. He claimed the approximately three years of pass-through payments were the result of Stern financing a large toxic tort case Plezia was handling. To back up his false story about the money flow, Plezia produced falsified documents in response to a federal grand jury subpoena. These included an alleged 2010 letter from Plezia to Stern proposing the financing arrangement and invoices allegedly from Esquivel that purported to bill Plezia for services on the tort case.

Both Stern and Esquivel previously pleaded guilty and provided testimony that the payments through Plezia had nothing to do with the tort case. The jury heard corroborating evidence from multiple attorneys and medical providers who were involved in the matter.

U.S. District Judge Lee H. Rosenthal presided over the trial and set sentencing for May 31. At that time, Plezia faces up to 20 years for the falsification of records and five years on each of the other convictions.

Plezia was permitted to remain on bond pending that hearing.

Stern and Esquivel, both of Houston, are also pending sentencing.

IRS-CI conducted the investigation. Assistant U.S. Attorneys Robert S. Johnson and Richard Bennett are prosecuting the case.