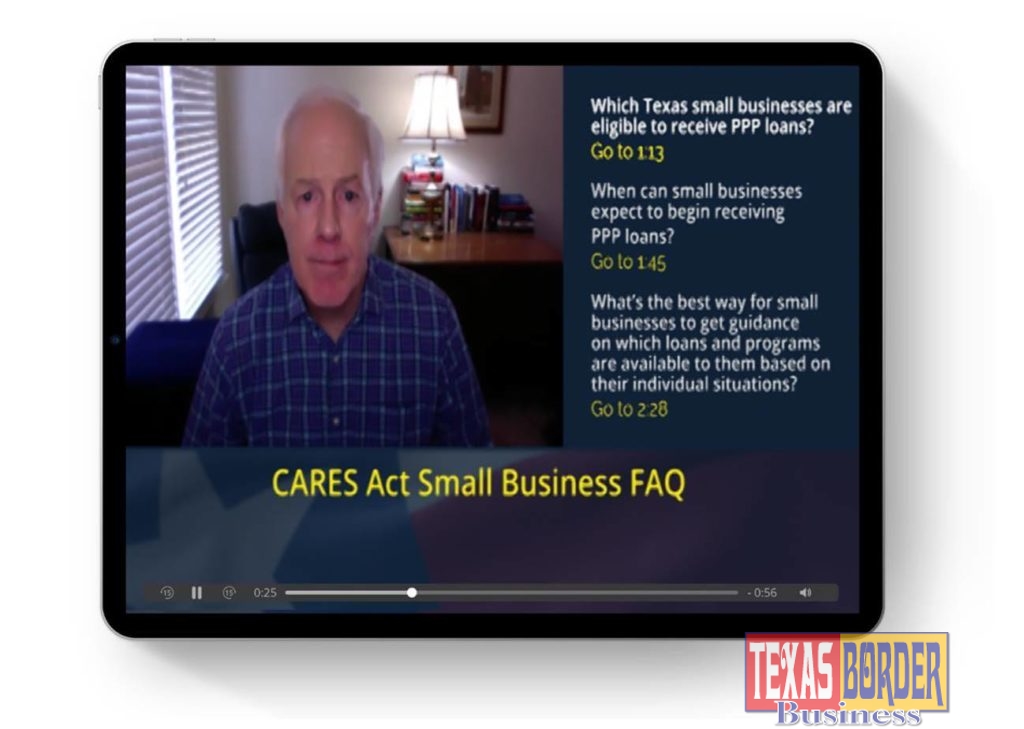

WASHINGTON—U.S. Senator John Cornyn (R-TX) today released a video for Texas small businesses explaining the federal resources offered to them through three coronavirus relief bills passed by Congress last month. In the video, he answers some of the most frequently asked questions he has heard on more than 40 conference calls with small business owners, local Chambers of Commerce across Texas, and other Texans. You can read more about small business relief from the coronavirus outbreak below, and you can find a downloadable PDF with information here.

The Coronavirus Aid, Relief, and Economic Security (CARES) Act

Became Law March 27, 2020

Sen. Cornyn’s Statement and Texas-Specific Summary

- Establishes a $350 billion SBA-backed “Paycheck Protection Program” to provide eight weeks of cash-flow assistance through 100 percent federally-guaranteed loans to small businesses who maintain their payroll

- The loan amount can be up to 250 percent of an employer’s average monthly payroll, with a maximum loan of $10 million.

- The loan can be used to cover payroll costs (salary, wages, payment of cash tips up to an annual rate of $100,000; employee group health care benefits including insurance premiums, retirement contributions, and covered leave), paid sick leave, supply chain disruptions, employee salaries, mortgage payments, and other debt obligations to provide immediate access to capital for small businesses who have been impacted by COVID-19.

- If employers maintain their payroll, certain portions of the loans can be forgiven, including payroll, interest on mortgage obligations, rent, and utility payments.

- Loans will be available through more than 135 existing SBA-certified lenders in Texas, including banks, credit unions, and other financial institutions.

- The maximum loan amount for SBA Express loans is increased from $350,000 to $1 million, providing borrowers with revolving lines of credit for working capital purposes.

- Note: Any small business awarded this type of SBA loan cannot receive the retention credit or a deferral on their payroll taxes.

- Includes $265 million for counseling, training, and related assistance to small businesses affected by COVID-19 through grants to SBA resource partners, including Small Business Development Centers and Women’s Business Centers, and includes $10 million for the Minority Business Development Agency to provide these services through Minority Business Centers and Minority Chambers of Commerce

- Expedites access to $10 billion in capital by allowing small businesses who have applied for an Economic Injury Disaster Loans (EIDL) loan to request an emergency advance of up to $10,000 within three days to provide paid sick leave to employees, maintaining payroll, and other debt obligations

- It also allows business with EIDL loans from previous disasters (floods, hurricanes, wildfires, etc.) to apply for paycheck protection program loans and provides a refinancing mechanism for easy repayment.

- Offers loan forgiveness by requiring SBA to pay all principal, interest and fees on all new and existing SBA loan products including 7(a), Community Advantage, 504, and Microloan programs for six months

- Allows loan forgiveness for additional wages paid to tipped workers

- Expands small business benefits to sole-proprietors, independent contractors, self-employed individuals, and businesses with more than one physical location of less than 500 employees each in certain industries

- Allows and encourages the Dept. of the Treasury to approve additional lendersfor SBA loans, in addition to the 135 already approved in Texas

- Allows employers and self-employed to defer payment of the employer share of the Social Security tax with half the amount required to be paid by December 31, 2021 and the other half by December 31, 2022 if they choose not to use the Paycheck Protection Program

- Fixes the tax code to allow Qualified Improvement Property (QIP) eligibility for 100 percent bonus depreciation to allow small businesses to reasonably deduct major spending for improvements made to existing property

- Modifies the limitations on net operating losses (NOL) to allow small businesses to utilize losses for cash flow and liquidity

- It relaxes the taxable income limitation on a company’s use of losses and suspends the excess business loss limitation applicable to non-corporate taxpayers for taxable years 2018, 2019, and 2020. Significantly, taxpayers can carryback losses created in 2018-2020 back five years. [Therefore, some businesses could be provided a 21 percent rate on taxable income and carryback losses into a higher taxable year at 35 percent.]

- It also accelerates the ability for companies to recover refundable AMT credits.

- Temporarily increases the amount of business interest expense businesses may deduct on their tax returns from 30 percent to 50 percent of taxable income for 2019 and 2020. Special rules apply for partnerships

- Offers a temporary Refundable Employer Retention Credit for businesses who choose not to use the Paycheck Protection Program and continue to pay their employees despite suffering a reduction of at least 50 percent in gross receipts or being forced to shut down because of government orders. Special rules apply depending on the business’ size.

- Provides bankruptcy relief for small businesses by raising the maximum debt threshold for eligibility to $7.5 million and excluding coronavirus-related payments from the federal government from income for purposes of filing bankruptcy

- This provision sunsets after one year, when the eligibility threshold will return to $2,725,625.

The Families First Coronavirus Response Act

Became Law March 18, 2020

- Provides refundable payroll tax credits for small businesses to help employers with the additional costs imposed by the new Emergency Paid Leave Act and the Family and Medical Leave Act (FMLA) expansion through the end of 2020

- The sick leave credit would cover up to $511 per day per employee receiving paid sick leave to care for themselves with a coronavirus-related illness, or $200 per employee per day if the sick leave is to care for a family member with a coronavirus-related illness, including their child if school is closed. This translates to payroll tax credits of up to $132,000 for sick leave.

- The family leave credit would cover up to $200 per day, or an aggregate of $10,000. This translates to payroll tax credits of up to $78,000 for FMLA.

- Both tax credits are applied against the self-employment tax, covering 100 percent of the self-employed individual’s sick leave or 67 percent of family leave.

- Small businesses with less than 500 employees can be exempt by the Secretary of Labor from the paid family leave provisions if complying would put them out of business.

The Coronavirus Preparedness and Response Supplemental Appropriations Act, 2020

Became Law March 6, 2020

- Makes $1 billion in disaster loan subsidies available for small businesses, small agricultural cooperatives, small aquaculture producers, and non-profit organizations impacted by financial losses as a result of the coronavirus outbreak

This funding could enable SBA to provide an estimated $7 billion in loans, and also appropriates $20 million to administer these loans.