Texas Border Business

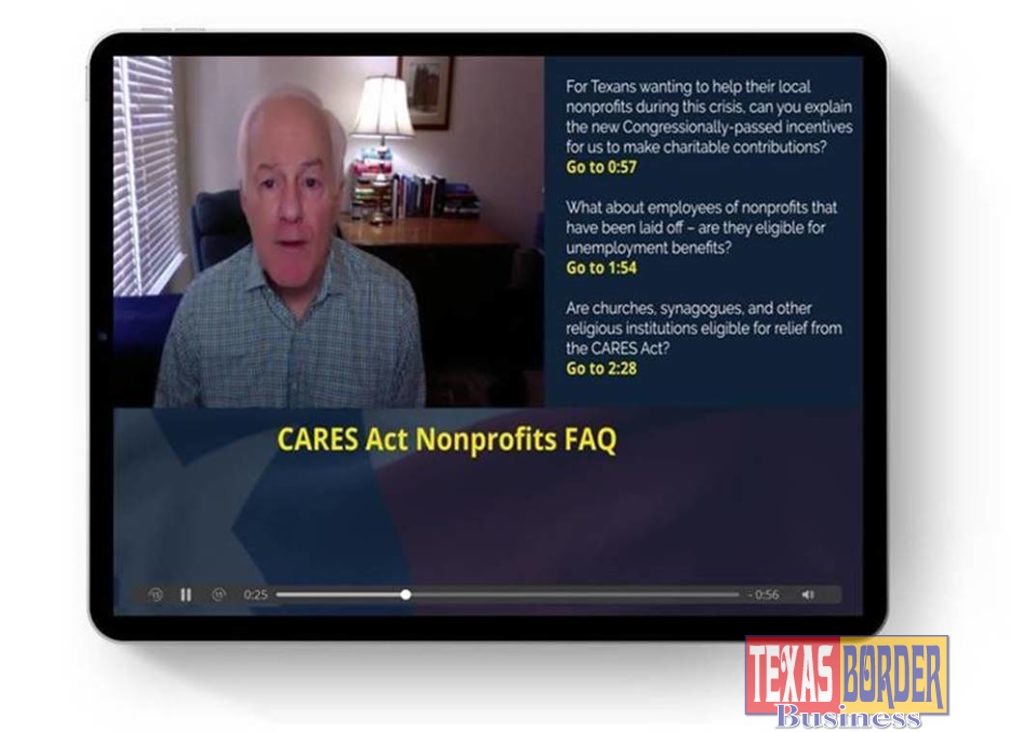

WASHINGTON—U.S. Senator John Cornyn (R-TX) today released a video for Texas nonprofitsexplaining the federal resources offered to them through three coronavirus relief bills passed by Congress last month. In the video, he answers some of the most frequently asked questions he has heard on more than 40 conference calls with Texas nonprofits, Texas workers, and others. You can read more about resources for Texas nonprofits during the coronavirus outbreak below, and you can find a downloadable PDF with information here.

The Coronavirus Aid, Relief, and Economic Security (CARES) Act

Became Law March 27, 2020

Sen. Cornyn’s Statement and Texas-Specific Summary

- Incentivizes charitable giving by increasing the amount Texans can deduct from their taxes for charitable contributions

- It allows taxpayers to deduct up to $300 in cash contributions to churches and charitable organizations in 2020 whether they itemize their deductions or not.

- For individuals who itemize their deductions in 2020, it suspends the 50 percent adjusted gross income limitation.

- For corporations, it increases the 10 percent adjusted gross income limitation to 25 percent of taxable income.

- It also increases the limitation on deductions for contributions of food inventory from 15 percent to 25 percent.

- Expands access for private nonprofits to Emergency Economic Injury Disaster Loans (EIDL) from the Small Business Administration

- You can apply for an SBA Disaster Loan at the SBA website.

- Expedites access to $10 billion in capital by allowing small businesses and nonprofits who have applied for an Economic Injury Disaster Loans (EIDL) loan to request an emergency advance of up to $10,000 within three days to provide paid sick leave to employees, maintaining payroll, and other debt obligations

- Directs the Dept. of the Treasury to target loans for nonprofit organizations and businesses between 500 and 10,000 employees

- The funds received must be used to retain at least 90 percent of the recipient’s workforce with full compensation and benefits through September 30, 2020.

- The recipient must not outsource or offshore jobs for the term of the loan plus two years.

- Allows and encourages the Dept. of the Treasury to approve additional lenders for SBA loans, in addition to the 135 existing SBA-certified lenders in Texas

- Provides deferral of employer payroll taxes to those who do not use the Paycheck Protection Program with half the amount required to be paid by December 31, 2021 and the other half by December 31, 2022

- Offers a temporary Refundable Employer Retention Credit for all 501(c) organizations who do not use the SBA-backed Paycheck Protection Program and continue to pay their employees despite suffering a reduction of at least 50 percent in gross receipts or being forced to shut down because of government orders

- This provision provides a refundable payroll tax credit for 50 percent of wages paid from March 13 through December 31, 2020 by eligible employers to employees during the COVID-19 crisis.

- For organizations with 100 or fewer full-time employees, all employee wages qualify for the credit, whether the employer is open for business or subject to a shut-down order. For organizations with more than 100 full-time employees, this provision applies to wages paid to employees when they are not providing services due to COVID-19-related circumstances.

- Provides emergency unemployment relief for nonprofit organizations by providing funding for states to reimburse nonprofits for half of the costs they incur through December 31, 2020 to pay unemployment benefits

- Establishes a $350 billion SBA-backed “Paycheck Protection Program” to provide eight weeks of cash-flow assistance through 100 percent federally-guaranteed loans to small businesses and 501(c)(3) nonprofits, 501(c)(19) veterans’ organizations, and 31(b)(2)(c) tribal organizations who maintain their payroll

- To apply for an SBA Interruption Loan, please contact your local creditor. Loans will be available through more than 135 existing SBA-certified lenders in Texas, including banks, credit unions, and other financial institutions.

- The loan amount can be up to 250 percent of an employer’s average monthly payroll, with a maximum loan of $10 million.

- The loan can be used to cover payroll costs (salary, wages, payment of cash tips up to an annual rate of $100,000; employee group health care benefits including insurance premiums, retirement contributions, and covered leave), paid sick leave, supply chain disruptions, employee salaries, mortgage payments, and other debt obligations to provide immediate access to capital for small businesses who have been impacted by COVID-19.

- If employers maintain their payroll, certain portions of the loans can be forgiven, including payroll, interest on mortgage obligations, rent, and utility payments.

- The maximum loan amount for SBA Express loans is increased from $350,000 to $1 million, providing borrowers with revolving lines of credit for working capital purposes.

- Note: Any organization awarded this type of SBA loan cannot receive the retention credit or a deferral on their payroll taxes.

- Provides direct relief for eligible members and employees

- This bill provides a recovery check of $1,200 for each Texan earning up to $75,000 and a check of $2,400 for a couple making $150,000 or less, plus $500 per child.

- This applies to Texans with or without income, as well as those whose income comes entirely from non-taxable means-tested benefit programs, such as SSI benefits. Individuals who are a dependent of another taxpayer are not eligible to receive a check.

- The amount is reduced by $5 for each $100 that a taxpayer’s income exceeds $75,000, and the amount is completely phased-out for single filers with incomes exceeding $99,000 or joint filers with no children with incomes exceeding $198,000.

- The IRS will base these amounts on the taxpayer’s 2019 tax return, but if the taxpayer has not yet filed, the rebate will be based on the taxpayer’s 2018 return. If the amount received by an individual is incorrect based on old tax returns, an adjustment will be made in next year’s tax returns only to reflect a higher amount the individual should have received.

The Coronavirus Preparedness and Response Supplemental Appropriations Act, 2020

Became Law March 6, 2020

- Makes $1 billion in disaster loan subsidies available for nonprofits, small businesses, small agricultural cooperatives, and small aquaculture producersimpacted by financial losses as a result of the coronavirus outbreak

- This funding could enable SBA to provide an estimated $7 billion in loans, and also appropriates $20 million to administer these loans