Texas Border Busniness

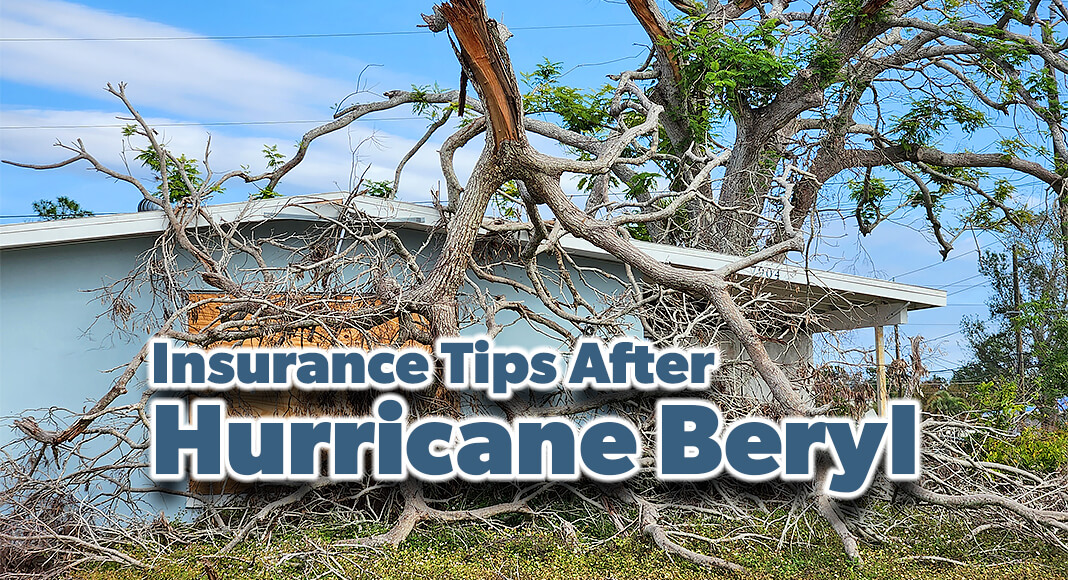

If you experienced damage from Hurricane Beryl, contact your insurance company to start a claim. If you still have questions, the Texas Department of Insurance (TDI) has specialists ready to help. Call the TDI Help Line at 800-252-3439.

“You need to get your claim started as soon as possible,” said Insurance Commissioner Cassie Brown. “We can help you if you run into an issue contacting your insurance company or just don’t understand what you’re hearing from them.”

Filing an insurance claim

- Contact your insurance company or agent as soon as possible.

- Keep a list of everyone you talk to. Be ready to describe the damage.

- Make a list of damaged property. Take pictures or video. Don’t throw away damaged items until you talk to your insurance company or adjuster.

- Try to protect your property from further damage. Cover broken windows and holes to keep out rain and prevent vandalism or theft.

- Ask about additional living expenses if you can’t live in your home due to the damage or power outages. Your insurance may pay some of those expenses.

- Save proof you paid the deductible on your claim. State law makes it illegal for contractors or roofers to offer to waive a deductible or to promise a rebate for the amount.

- In addition to filing your insurance claim, be sure to tell the Texas Division of Emergency Management about the damage. This will help Texas to receive as many recovery funds as possible. Report damage at iSTAT Damage Surveys.

Flood damage

- Most home and renters policies don’t cover flood damage. Check your policy or call your agent if you aren’t sure about your coverage.

- If you have flood insurance, call your agent or company as soon as possible. Federal flood policies require you to file a claim and document your losses within 60 days.

- Your personal auto policy may cover flood damage if you have comprehensive coverage. If your car was flooded or damaged, call your insurance company or agent as soon as possible.

Avoiding contractor scams

- Get written estimates on company letterhead with clear contact information.

- Get more than one bid to gauge which ones are too high or too good to be true.

- Check references and phone numbers. Beware of contractors who only have out-of-town references or solicit door-to-door.

- Don’t pay in full upfront and don’t make a final payment until the job is done.

- Be sure to read and understand any contracts before signing and don’t sign a contract with blanks to be filled in later.

Resources

- Help after a disaster

- Anti-Fraud toolkit for cities and counties

- Power out, food spoiled? Your insurance might help.

For more information, contact: MediaRelations@tdi.texas.gov