Texas Border Business

By Curtis Dubay

Chief Economist, U.S Chamber of Commerce

A strong economy means more opportunities for growth in communities across the country. It means higher paychecks and more chances for Americans to reach their American dream.

The U.S. Chamber has a bold plan for achieving a sustained level of at least 3% real economic growth to help our nation and American families prosper.

| Key Points: |

| Looking backward: At the end of 2025, the U.S. economy will have grown around 2% over the last 12 months, which is remarkable given turbulence throughout the year. |

| Looking forward: In 2026, the U.S. Chamber predicts the economy will grow at least 2% — which is the average of Blue Chip forecasters. |

| The catch: If we establish the right set of policies, the economy could grow at 3% or above. |

| Bottom line: That higher level of growth is attainable, but policymakers need to act to achieve it. |

Why 3% Growth Matters

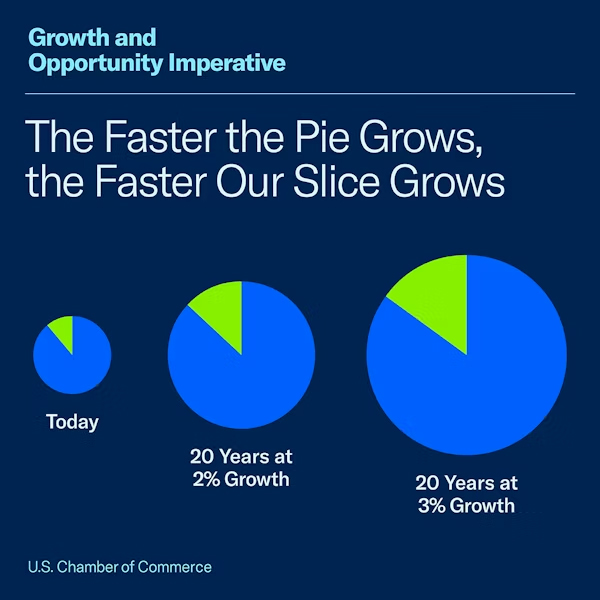

To improve the lives of all Americans, the U.S. must focus on growing the economy. In 2024, the Chamber launched the Growth and Opportunity Imperative, calling on elected officials to support policies that would achieve at least 3% annual real economic growth over the next decade.

When the economy is growing at 3%, someone who is born today will see America’s economy double in size by the time they are in their early 20s. At 2% growth, it will take until they are in their mid-30s for the economy to double. Plainly put, growing the economy grows everyone’s slice of the pie and creates more prosperity across the board.

Unfortunately, several tailwinds and headwinds impact our ability to reach that target.

Why the Economy Will Grow 2% in 2026

The economy is sustaining 2% growth and will continue to do so into 2026 for a few key reasons:

• Consumers keep spending, and

• Businesses are investing.

Consumers are spending because the job market remains strong, even if it has weakened some in recent months. People can still get jobs, and wage growth remains above inflation. Even if necessities are chewing up more of budgets as inflation remains stubbornly high, consumers are at least keeping pace. The latest data we have from early fall shows this remains the case.

A steadily rising stock market and tax reform putting more money into families’ pockets are also contributing to strong spending numbers.

Businesses are investing in AI in a big way. That is keeping investment numbers up and keeping lots of people more than fully employed. Tax reform promises to boost investment in other areas as it lowers the cost of all types of investment.

If outside influences do not change, these two factors alone will keep the economy growing at 2%, at a minimum, in 2026.

How tariffs play a role: Trade flows are pushing the growth numbers up and down depending on the quarter and what businesses are doing with imports in response to tariffs. While we may see one quarter depressed by a surge of imports and another surge because of a drop in imports, these swings will level off eventually. Ultimately, tariffs are a drag on growth because they raise prices, causing consumers and businesses to buy less.

How We Could Reach 3% Growth in 2026

The U.S. is by no means hemmed into 2% growth. The dynamism of the U.S. economy means there is always capacity for the economy to grow above its potential. In 2026, we could see 3% growth, or higher, if a few key things happen:

• AI continues booming, and most importantly, it starts seriously boosting worker productivity;

• The positive economic benefits from the One Big Beautiful Bill take off in 2026, such as improved incentives for businesses to invest, leading to an even bigger investment boom that encompasses more than AI investment. Large refunds and reduced withholding could add extra juice to the economy in 2026 as well;

• Permitting reform makes it easier and faster to build;

Continued deregulatory activities and greater policy certainty make it easier for businesses to plan and invest;

• Legal immigration reforms make it easier to get the workers we need to grow faster;

• We enact legal reforms that discourage frivolous litigation help reduce the cost pressure on everything from insurance to consumer goods; and

• Tariffs come down. Lesser tariffs and more free trade would supercharge growth.

• This mix of policies that emphasize the supply side of the economy is imperative to generating improved growth because where inflation is now, anything that spurs demand — like more government stimulus like we saw under the Biden administration — risks greater inflation.

What Could Slow Growth in 2026

While the right set of policies could drive the economy to 3% growth, the wrong set could slow it below the 2% path we are on now. Those policies would be those that:

Slow AI investment: A wave of different regulatory policies from the federal government and the states would slow business investment in data centers and other factors needed to bring AI to consumers. This would cause a pullback in financial markets and cause a slowdown in on-the-ground activity. It could lead to a consolidation of businesses engaged in bringing AI to market and a reduction in asset prices tied to the ongoing investment boom;

Raise tariffs: New, higher, or expanded tariffs would cause consumers and businesses to pull back and will slow growth; and

Decrease consumer confidence: Consumers have been spending strongly for years now, in part because their wages have grown above inflation and their belief the economy will be better in the future. If continued policy uncertainty undermines their confidence, they could pull back on spending, which would certainly slow growth.

Other Factors to Consider in 2026

Recession

We won’t have a recession this year unless a large shock occurs, like a pandemic or global financial crisis. While there is always the chance something big like that happens, such events are hard to predict. It is important to remember that slower growth is not the same thing as a recession.

We could have slower growth in 2025 and 2026 than we had in 2023 (2.9%) and 2024 (2.8%), but a recession is when the size of the economic contracts for six straight months. Slower growth is not good, and it can make the country feel the economy is bad. But a recession brings with it more serious economic pain through high unemployment and falling incomes. Both are unlikely to occur outside of a recession.

Workforce

The U.S. labor market has fundamentally changed in recent months. Because of declining population growth from a lower birth rate and a slowdown in immigration and increase in deportations, we only need to add 30,000 to 50,000 jobs a month to keep the unemployment rate steady. Not too long ago, we needed to create at least 125,000 jobs a month to keep the unemployment rate the same.

That means if we do get the conditions needed to push growth to 3%, it will be harder to hit that mark than in the past because there won’t be enough workers available for businesses to tap to meet growing demand.

The Fed

The Federal Reserve is another factor to consider in 2026. While some anticipate further rate reductions to spur faster growth, there is also ample reason to believe that rates will remain more steady.

The Fed’s dual mandate requires them to work towards stable prices and maximum employment. Inflation remains stubbornly high and tariffs continue to work their way through to consumers exerting upward pressure on the price level. At the same time, while job growth may have slowed, the unprecedented slowdown in the growth of the labor force may mean that there is little room to create more jobs. Given these pressures, it is not surprising that the Fed signaled in its most recent forward guidance that it is likely to hold rates steady for several months while until we have a better understanding of where inflation and labor force are headed.

The Bottom Line

The economy is stronger than many surveys would indicate, and the economy will continue to grow in 2026. With the right mix of policies, the economy can grow even faster. Businesses will want to prepare for a better economy because they will need to be ready to hire and expand to take advantage of that faster growth should it materialize.