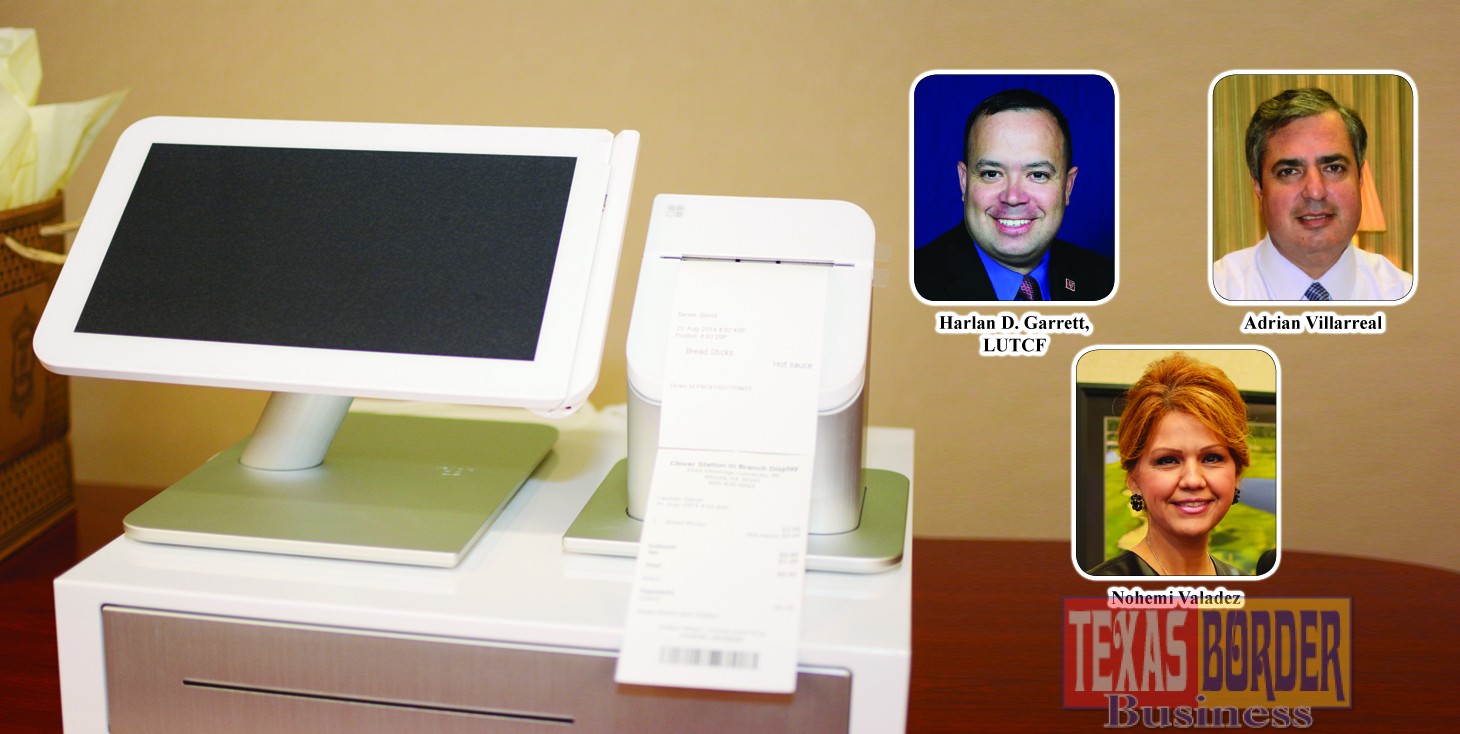

And the Introduction of a New Modern Cash Register

Texas Border Business

By Roberto Hugo Gonzalez

IBC Bank hosted a fraud prevention seminar for local businesses at the McAllen Chamber of Commerce meeting room. Fraud prevention is, without a doubt, one of the most popular topics of our times. This is the second consecutive year that IBC presents a seminar with such valuable information that businesses can use to protect themselves.

The other topic presented is also of great importance to all merchants that accept credit cards. Big changes are coming with new announced technology, chip cards. Are you ready for what is coming?

The presenters were Nohemi Valadez of First Data who enlightened attendees on all the upcoming important nationwide changes, and Harlan D. Garrett, LUTCF, IBC’s insurance representative.

Garret, who is an insurance agent for the IBC McAllen market, said, “I specialize in commercial insurance, life insurance, and health insurance.”

Garret is one who knows very well what Cyber Liability is. He explained that Cyber Liability is first- and third-party protection in the event of a cyber-breach.

He told Texas Border Business that most business owners think a data breach only happens to big national chains or corporations. Unfortunately, he points out that is the furthest from the truth. He said, “Small businesses with less than 100 employees account for 31% of all data breaches.” He questions, “After you experienced a data breach, are you prepared to handle the financial cost of notifying your clients, patients, business partners, and employees. Are you ready to handle the impending lawsuits? Would you even know where to begin? What would you say if I told you that I can help protect your business after you have been breached?”

In case of an event like this, Garret said that Pro-breach coverage helps their clients with notifying their employees, clients, patients, and business partners of the breach, paying for credit monitoring, public relations and crisis management, determining the extent and duration of the breach, and breach containment. He said, “The last part of cyber liability is liability protection in the event you are sued after you have had or are suspected of having a been breached.”

He went on to explain, “The coverage is broken down into three areas – pre-breach protection, post-breach protection, and liability protection. Pre-breach coverage provides education, assistance in developing an incidence response plan, and regulatory compliance.”

Garret has worked with IBC since 2012 and has over 10 years of insurance experience under his belt. He said that IBC Bank, First Data Solutions, and IBC Insurance hosted a very similar seminar last year in order to educate businesspeople at no cost to the customers.

The seminar showcased information regarding how to prevent credit and debit card fraud; it also highlighted how to properly secure a business in success against financial identity thieves. Further, it included pertinent information regarding nationwide changes to debit and credit cards for 2015, and best practices to prepare one’s business for necessary changes.

For this matter it was Nohemi Valadez, a representative of First Data, who said merchants need to be prepared to accept chip-based smart cards (EMV) ahead of the October 2015 shift in liability for card fraud from the issuing bank to the merchant.

She pointed out that EMV is a technical standard that ensures chip-based payment cards (also known as smart cards) and terminals are compatible around the world. She said, “A chip-based payment transaction occurs when a microprocessor embedded in a plastic card or mobile phone connects to an EMV-enabled POS terminal (either contact or contactless) in order to execute a payment.”

The smart card technology provides an additional form of card authentication for the transaction—validating the legitimacy of the payment type being used and helping reduce the use of counterfeit, lost and stolen payment cards at ATMs and retail points of sale.

The company that she represents is First Data, a global technology leader in the financial services industry. With 24,000 employee-owners and operations in 35 countries, the company provides secure and innovative payment technology and services to more than six million merchants and financial institutions around the world, from small businesses to the world’s largest corporations.

Valadez has been in the industry for 20 years and working with First Data since 2000. But as of 2014 due to the change that will take in effect in October 2015, she has been working, “Providing merchant awareness of the change and for them to have enough time to make the proper updates on their technology to be in compliance with the new EMV cards.”

The free educational seminar provided business leaders and small business owners the opportunity to gain the knowledge and tools necessary to prevent fraud. The seminar, and complimentary breakfast, took place at the McAllen Chamber of Commerce; it was an Exclusive edition of IBC Bank-McAllen.

“IBC Bank is committed to increasing educational awareness regarding how businesses can work to prevent and combat credit and debit card fraud,” IBC Bank-McAllen Senior Executive Vice President, Adrian Villarreal said. “We are proud of our dedication to offering continued education opportunities regarding nationwide changes to Merchant Services, which could directly affect area businesses.” TBB