Department of Justice

U.S. Attorney’s Office

Southern District of Texas

Texas Border Business

HOUSTON – A 21-count superseding indictment has been unsealed alleging conspiracy, witness tampering, obstruction of justice and multiple tax violations in a barratry scheme, announced U.S. Attorney Ryan K. Patrick.

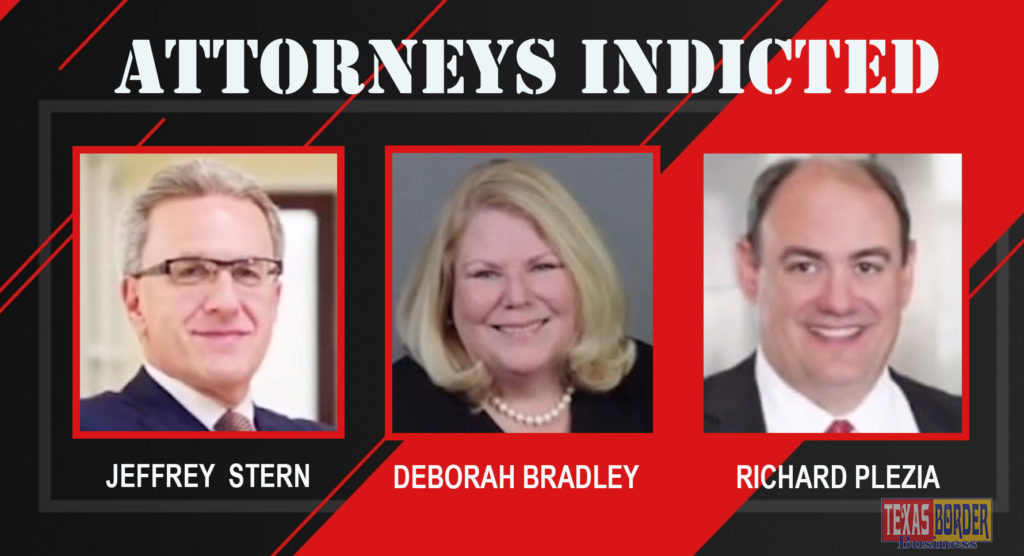

Houston personal injury attorneys Jeffrey Stern, Deborah Bradley and Richard Plezia are charged with conspiracy and tax violations along with legal-assistant Frederick Morris and clinic-owner Lamont Ratcliff. Stern is also charged with witness tampering and obstruction of justice.

Stern made his initial appearance yesterday and was temporarily ordered into custody pending a detention hearing set for Aug. 22, at 1:00 p.m. Bradley and Ratcliff were permitted release upon posting bond. Plezia is expected to make his initial appearance later this week.

Morris made his initial appearance earlier and has since pleaded guilty. He was permitted to remain on bond.

The charges against Stern and his alleged co-conspirators stem from a long-running criminal scheme to evade taxes. Stern also allegedly obtained his personal injury cases through barratry – the illegal practice of soliciting law firm clients by paying kickbacks to middlemen known as “case runners.”

Stern and his co-conspirators sought to enrich themselves by illegally recruiting clients through the payment and receipt of illegal kickbacks in order to generate personal injury cases and legal fees, according to the charges. They allegedly worked to conceal and disguise the payments and hide their resulting income from the IRS by filing false documents with them. These allegedly included tax returns, 1099 forms and an offer in compromise that falsely reported material information including amounts of income, expenses and taxes due and owing.

Once Stern became aware of the investigation, he allegedly worked to obstruct justice by ordering others to destroy subpoenaed documents and instructing co-conspirators not to cooperate.

According to the indictment, Stern employed multiple devices to disguise his illegal kickback payments to case runners as legitimate referral fees paid to attorneys or as other types of legitimate payments that would be deductible under the tax laws. Stern allegedly funneled kickback payments to case runners Ratcliff and Marcus Esquivel (charged in a separate case) through the accounts of Bradley and Plezia. The charges allege Stern claimed the payments were legitimate referral fees to Bradley and Plezia rather than illegal kickbacks to Ratcliff and Esquivel.

The indictment also alleges Stern wrote referral fee checks in the names of attorneys who never received the checks. Instead, Morris would allegedly cash the checks with forged endorsements at check-cashing locations and use the funds to pay illegal kickbacks owed to himself and other case runners for Stern’s referrals.

Stern allegedly also filed 1099 forms that falsely reported to the IRS the nature of the payments and to whom they were made. On his tax returns, Stern falsely reported the illegal, non-deductible kickback payments as legitimate, deductible business expenses, which greatly reduced his tax burden, according to the charges.

Bradley and Plezia allegedly filed false tax returns to facilitate the scheme. Ratcliff failed to report many of the kickback payments he received as income on his company’s tax returns, according to the charges. Stern and Morris also allegedly caused another attorney to file false tax returns and a false offer in compromise with the IRS to help cover-up the scheme.

All defendants are charged with conspiracy to defraud the United States. If convicted, they each face up to five years in prison. For willfully filing a false tax return, Stern, Ratcliff and Bradley face another three years of imprisonment. Aiding and assisting in the preparation and presentation of false tax returns carries another potential three-year-term, for which Stern and Morris are charged. If convicted of witness tampering or obstruction of justice, Stern could be sentenced up to 20 and 10 years, respectively.

Morris entered a guilty plea Aug. 8, 2019, to the conspiracy. He is set for sentencing in February 2020.

IRS – Criminal Investigation conducted the investigation. Assistant U.S. Attorney Robert S. Johnson is prosecuting the case.

An indictment is a formal accusation of criminal conduct, not evidence.

A defendant is presumed innocent unless convicted through due process of law.

Below the Superseding Indictment: