Texas Border Business

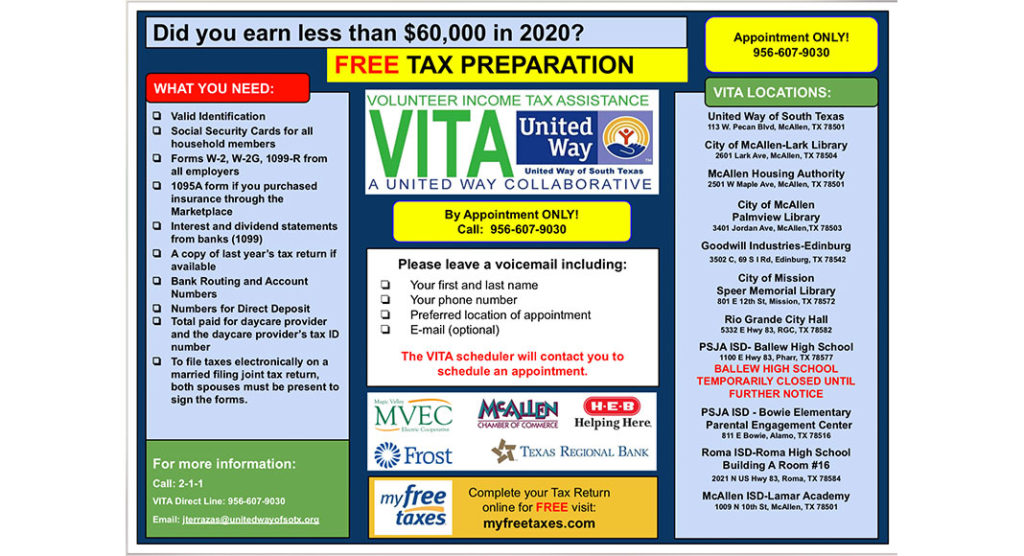

PHARR — The United Way Volunteer Income Tax Assistance (VITA) program is now offering free income tax preparation at Pharr-San Juan-Alamo ISD (PSJA) locations to families earning less than $60,000 a year. Due to new health and safety measures implemented, these services will be offered by appointment only.

Sponsored by the Internal Revenue Service (IRS), the VITA program offers free assistance to people with a household income of $60,000 or less, residents with disabilities, elderly and limited English-speaking taxpayers. IRS-certified volunteers provide free basic income tax return preparation with electronic filing to individuals who qualify.

Individuals interested in receiving income tax preparation services must call to make their appointment at (956) 607-9030, leave their name, phone number, email and their preferred site location.

Several PSJA ISD high school students who are part of the district’s Career and Technical Education Program, have completed coursework and are now IRS-Certified volunteers. They plan to assist at the PSJA sites during this tax season. PSJA students have been part of these efforts for several years now as part of their business coursework. Providing these services to the community helps students gain invaluable experience and are part of PSJA ISD’s efforts to ensure every student has the experiences and resources necessary to achieve the highest levels of success.

This year, tax preparation assistance is being provided at the following PSJA ISD locations:

PSJA Bowie Parent & Community Center (811 E. Bowie, Alamo, TX) – To reopen Feb. 15, 2021

Tuesdays & Thursdays | Jan. 26, 2021 – April 1, 2021

PSJA Elvis J. Ballew CCTA (1100 E. Hwy 83, Pharr, TX)

Mondays, Tuesdays, Thursdays & Saturdays | Feb. 1, 2021- April 12, 2021

The site will be closed March 14-20, 2021 for Spring Break.

Those who qualify must provide a valid Identification and Social Security Cards or Taxpayer Identification Numbers (TIN) for all household members to receive assistance.

In addition to the following items, if applicable: Forms W-2, W-2G, 1099-R from all employers; Interest and dividend statements from banks (Form 1099); a copy of last year’s return if available; bank routing numbers and account numbers for direct deposit; total amounts paid for daycare providers and their tax identifying number. If filing a married joint tax return, both spouses must be present to sign the required forms.

For more information on the services offered, you may call (956) 607-9030 or send an email to jterrazas@unitedwayofsotx.org.