Texas Border Business

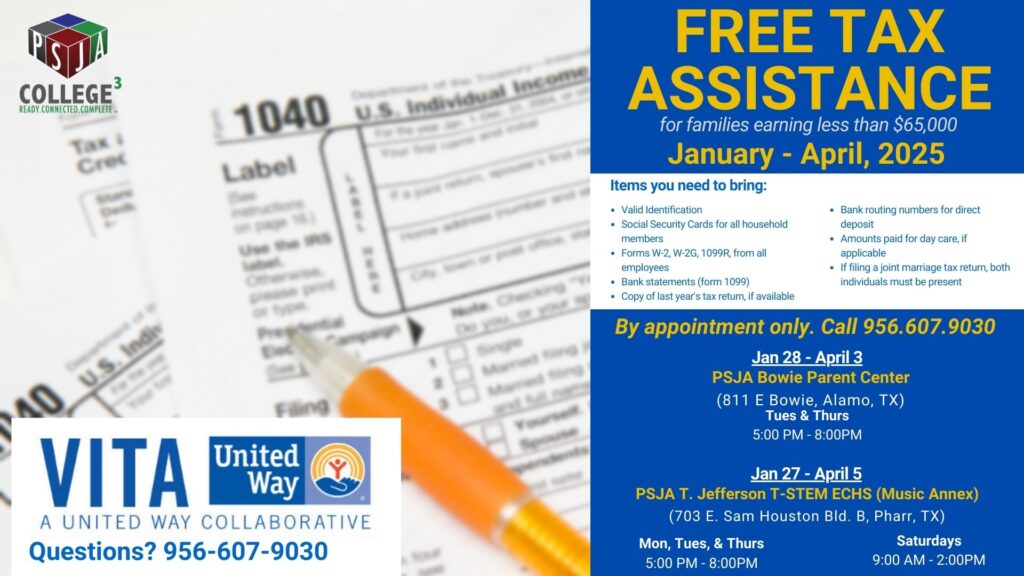

PHARR, Texas – The United Way Volunteer Income Tax Assistance (VITA) program will offer free tax preparation assistance services at two Pharr-San Juan-Alamo Independent School District (PSJA ISD) locations for families earning $65,000 or less annually. This assistance will continue until April 2025.

Sponsored by the Internal Revenue Service (IRS), the VITA program offers free assistance to people with a household income of $65,000 or less, persons with disabilities, the elderly, and limited English-speaking taxpayers. IRS-certified volunteers provide free basic income tax return preparation with electronic filing to individuals who qualify.

This year, tax preparation assistance is being provided at the following PSJA ISD locations:

| PSJA T-Jefferson T-STEM ECHS Music Annex Building |

| 703 E. Sam Houston Building B, Room 32, Pharr, TX 78577 |

| January 28 – April 3, 2025 Tuesday & Thursday | 5:00 pm – 8:00 pm |

| By Appointment Only: Call 956-607-9030 to set up your appointment. |

| PSJA ISD Bowie Parent Engagement Center |

| 811 E Bowie, Alamo, TX 78516 |

| January 27 – April 5, 2025 |

| Monday, Tuesday, Thursday | 5:00 pm – 8:00 pm Saturday | 9:00 am – 2:00 pm |

| By Appointment Only: Call 956-607-9030 to set up your appointment. |

| * Both locations will be closed on 3/17-3/22 for Spring Break. |

Those who qualify must provide valid Identification and Social Security Cards or Taxpayer Identification Numbers (TIN) for all household members to receive assistance, in addition to the following items, if applicable: Forms W-2, W-2G, 1099-R from all employers; Interest and dividend statements from banks (Form 1099); a copy of last year’s return if available; bank routing numbers and account numbers for direct deposit; total amounts paid for daycare providers and their tax identifying number. If filing a married joint tax return, both spouses must be present to sign the required forms.