Texas Border Business

By Dan Byers

Vice President, Policy, U.S. Chamber Global Energy Institute, U.S. Chamber of Commerce

US CHAMBER OF COMMERCE – It has been a rocky start to the summer for the U.S. economy. On June 10, the University of Michigan’s consumer sentiment index hit its lowest level in 52 years. A few days later, the latest Consumer Price Index (CPI) showed year-over-year inflation of 8.6% in May—the fastest pace in 41 years.

Not coincidentally, one day later, the nationwide average gasoline price topped $5.00 per gallon for the first time in history. According to GasBuddy.com, Americans are now spending $730 million more every day on gasoline than a year ago, and June alone could cost U.S. consumers $20 billion more to fill their tanks than in 2021.

But the impacts of energy prices on inflation go well beyond the price we see at the pump—higher costs for oil and natural gas ripple through the economy in countless but less obvious ways. We explore five key factors driving these dynamics below.

1. High diesel prices are flowing through to countless goods and services.

Gasoline is not the only fuel hitting all-time highs this summer. The average nationwide price for a gallon of diesel—used to power trucking, ships, railroads and so much more—hit a record $5.81 two weeks ago. In Southern California (home to the L.A. port complex through which 37% of all U.S. imports pass), prices are now north of $7 per gallon.

As energy expert Vaclav Smil observed, most goods that we eat, wear, and use “are transported at least once, and usually many times, by diesel-powered machines, often from other continents: clothes from Bangladesh, oranges from South Africa, crude oil from the Middle East, bauxite from Jamaica, cars from Japan, computers from China.”

Agricultural supply chains are particularly dependent on diesel. Crops are planted, fertilized, and harvested with diesel-powered tractors, after which diesel powered ships, trains, and trucks delivered finished food products to markets. In this sense, food inflation is a direct result of energy inflation, and the domino effect of record diesel prices spreading to restaurants and grocery stores is inevitable. It should therefore be no surprise that, after energy prices, the hottest inflation subcategories in May’s Consumer Price Index (CPI) data were meat and eggs (14% year-over-year), beverages (12%), dairy products (12%), cereals and bakery products (12%) and fruits and vegetables (9%).

2. Electricity prices are also on the rise, but impacts vary significantly by region.

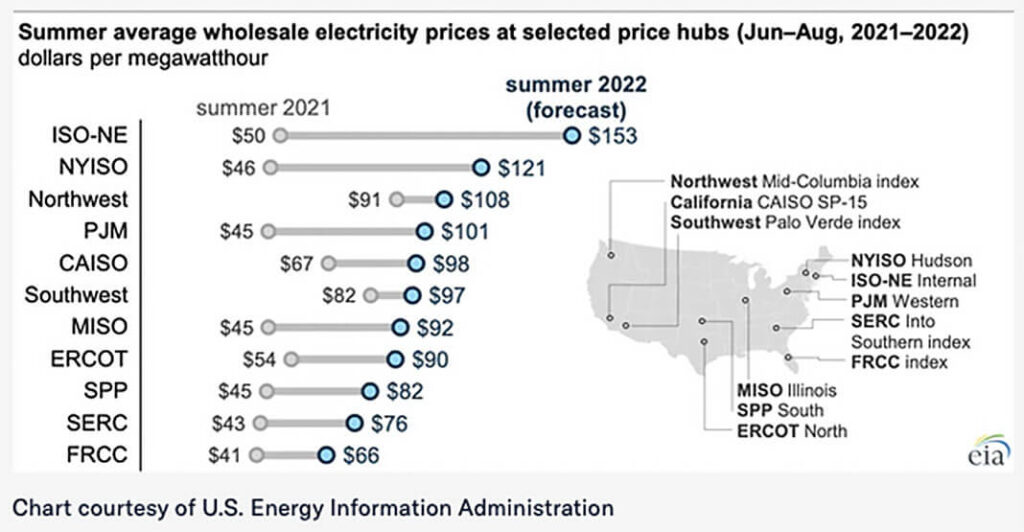

Electricity prices are also poised to increase significantly in 2022 and beyond, though the amount of electricity inflation varies considerably by region. At the wholesale level, the Department of Energy expects summer prices in New York and New England—already among the most expensive in the nation—to rise a whopping 163 percent and 206 percent over last year, respectively. This is largely because wholesale electricity markets are strongly influenced by natural gas prices, and northeastern states’ longstanding opposition to pipeline infrastructure has left power providers unable to access more affordable gas supplies from the Marcellus Shale region of Pennsylvania.

At the retail level, residential consumers tend to be more insulated from wholesale electricity price swings, but nonetheless will see a rise in prices. Summer rates are expected to rise 4.8 percent nationally, ranging from 2.4 percent in the West South-Central U.S. to 16.4 percent in pipeline-constrained New England.

3. High natural gas prices are impacting manufacturing, especially for energy intensive goods.

Unfortunately, record diesel prices are not the food and ag sector’s only inflation problem. Few manufactured goods are as energy intensive as fertilizer, and as global natural gas prices soared in the fall of 2021, so did fertilizer prices. According to the American Farm Bureau, prices increased between 100% and 300% over a period of just 15 months, then surged even more after Russia invaded Ukraine. Fertilizer costs have softened somewhat since the war began, but for a troubling reason: many farmers have halted fertilizer purchases, raising concerns that lower crop yields could lead to a global food security crisis later this year.

Meanwhile, on June 21st, the Wisconsin Manufacturers and Commerce association sent a letter to President Biden warning that, as the second-most manufacturing intensive state in the country, energy costs present a major headwind to Wisconsin’s economy. “The rising cost of energy is a direct threat to the vitality and global competitiveness of manufacturing in Wisconsin and across the U.S,” WMC wrote, calling on the administration to pursue “policies that will unleash the potential of inexpensive and efficient American energy.”

Related

- U.S. Chamber Statement on Proposed 5-Year Offshore Oil and Gas Leasing Plan

- U.S. Chamber Letter on the FY23 Interior, Environment, and Related Agencies Appropriations Legislation

- U.S. Chamber Letter on FY23 Energy and Water Development Appropriations

4. The global energy crisis is hurting Europe even more.

While rising energy prices are unquestionably a headwind for the U.S. economy, the trends here pale in comparison to the situation in Europe. A recent national survey of German businesses found that 93% of companies rate energy and raw materials prices as one of their biggest business risks.

According to Blackrock, Europe now spends over 9% of its GDP on energy, the highest share since 1981. This acts as an effective tax increase on consumers and businesses that extends from the fuel pump to the electric meter, and beyond. Current per gallon gasoline prices in Germany ($7.65), France ($8.27) and the UK ($8.39) dwarf those in the U.S. (in part due to higher taxes).

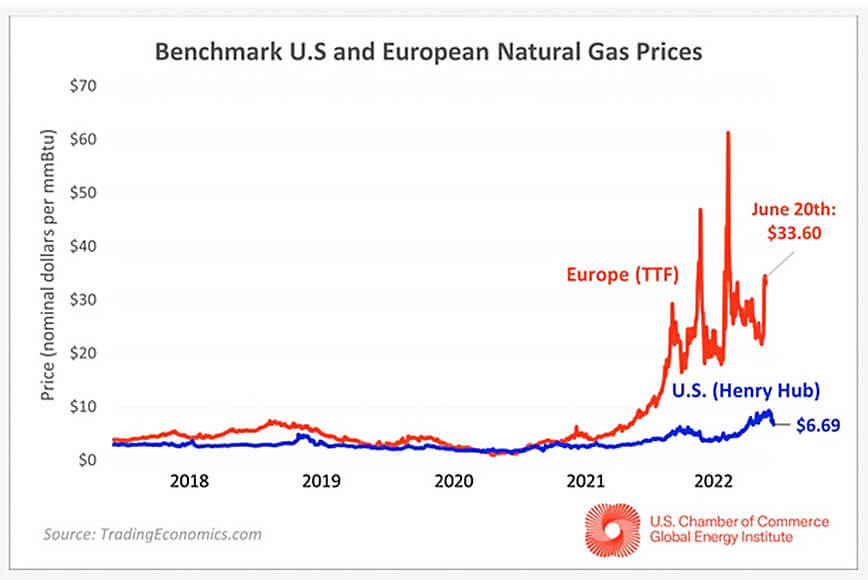

Natural gas and electricity costs provide no relief. Because natural gas tends to set the price of electricity in Europe, factories have been hit with a double whammy. For example, as of last week, the benchmark price for natural gas in Europe is an enormous $26 per million British Thermal Units (MMBtu) higher than its U.S. counterpart. Before diverging in the second half of last year, the spread between EU and U.S. natural gas prices had averaged just over $1.50 per MMBtu since January 2021.

Skyrocketing natural gas costs are reverberating through Europe’s economy and help explain why German producer price inflation is 33% higher than one year ago. As a result of these relative shifts, industrial demand may in fact be moving from Europe to the U.S., even in the face of higher domestic prices increases. Indeed, domestic natural gas consumption is forecast to increase about 3% this year, while European and Eurasian consumption decline by 6% and 5%, respectively.

Two weeks ago, the WSJ reported that a large fertilizer producer in the Netherlands has cut production and is now importing ammonia (a key fertilizer input) from Texas, Egypt and Algeria. As more data become available, we would not be surprised to see these trends extending to other energy intensive manufacturing sectors such as chemicals, steel, aluminum, and their affiliated end products (such as automobiles).

5. Relief isn’t around the corner, but it may be on the horizon.

We’ll finish with a bit of optimism. There is an adage in commodity markets: the cure for high prices is high prices—meaning that price signals drive responses in both production and demand. For a variety of reasons (such as ESG concerns and Biden Administration policies that discourage oil and gas investment), domestic energy companies have been hesitant to deploy capital for expanded production.

But there are some positive signs on the horizon. The Department of Energy’s most recent forecast anticipates domestic natural gas production to rise 3% this year and 5% next year, resulting in 2023 average prices of $4.74 per MMBtu—more than 40% below current levels. Similarly, DOE is forecasting U.S. oil production growth of 6% and 8% in 2022 and 2023, respectively. These increases, along with about 3 million barrels per day of new production from OPEC nations, contribute to a reduced 2023 gasoline price forecast of $3.79 per gallon. (Note: despite overall growth, DOE forecasts that Gulf of Mexico oil and natural gas production will decline by 6.3% and 10.6%, which is, respectively, likely due to the Administration’s ban on offshore leasing).

Of course, these are only modest improvements to the current energy-driven inflationary environment. The supply-demand balance in energy markets remains tight, and uncertainty associated with factors such as Russian supplies and post-COVID demand recovery could still impose upward price pressures.

Unfortunately, mixed signals—and sometimes outright hostility to the energy industry—have exacerbated uncertainty and the very investments that politicians are calling for. Simply imploring companies to produce more resources is not a solution. But concrete measures that fix broken permitting processes, support expanded pipeline infrastructure, and lift development restrictions on federal lands and waters would all enhance U.S. producers’ ability to respond to high oil and natural gas prices.

As Chevron CEO Mike Wirth recently explained: “You’re looking at committing capital ten years out, that will need decades to offer a return for shareholders, in a policy environment where governments around the world are saying, ‘We don’t want these products to be used in the future.'” For these reasons, it is important for the Biden Administration and other policymakers to foster a supportive environment for expanded oil and natural gas production. Until and unless that happens, it is likely that inflationary pressures will continue to persist.