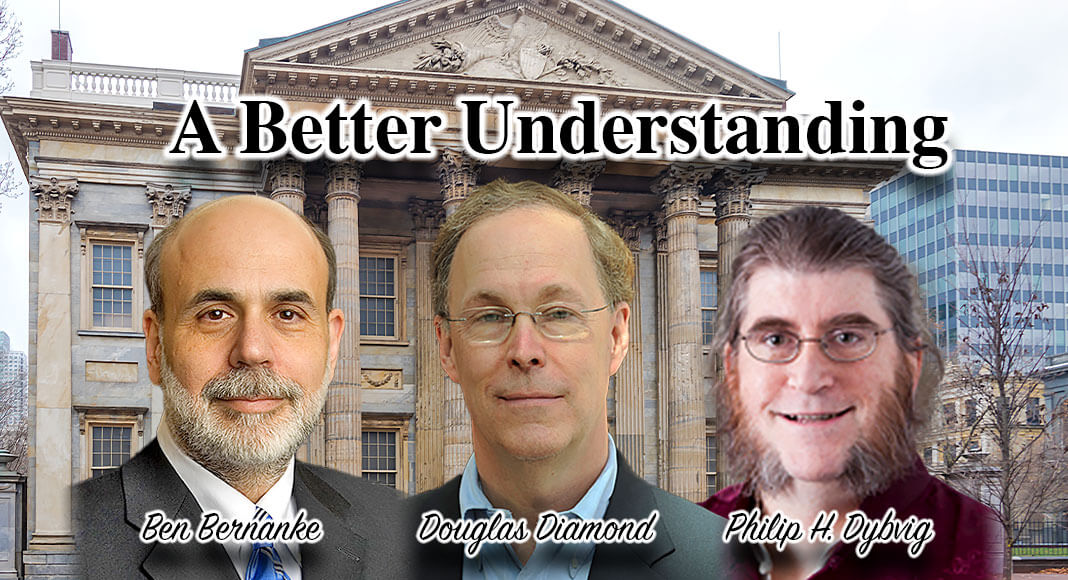

Ben Bernanke: United States Federal Reserve, Public domain, via Wikimedia Commons; Douglas Diamond: https://faculty.chicagobooth.edu/douglas-diamond; Philip H. Dybvig : https://olin.wustl.edu/

Texas Border Business

For the second consecutive year, the Nobel Memorial Prize in Economics has been awarded to three Americans. For 2022, the recipients are Ben S. Bernanke (former Federal Reserve Chairman now with The Brookings Institution), Douglas W. Diamond (University of Chicago), and Philip H. Dybvig (Washington University in St. Louis) “for research on banks and financial crises.”

Each year, the Royal Swedish Academy of Sciences awards the Prize (formally the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel) in recognition of ideas and research that increase our understanding of important issues in economics and related areas. Although most people are not interested in the pure economics of such research, the discoveries often shape public policy or even the way we think about the world which, in turn, affects the daily lives of virtually everyone.

This year’s winners focused on monetary economics and, in particular, how it applies to banks during financial crises. Each of these researchers looked at information asymmetries in banking, which involves the fact that potential borrowers know more about their creditworthiness than lenders, and how banks address the problem. They also looked at what happens during a financial crisis. This work provides important theoretical understanding, as well as practical application.

An important concept in Mr. Bernanke’s work was that banks can serve as an accelerator in business cycles. The traditional approach dating back to the 1800s is for banks to continue to lend during crisis situations, but only against very strong assets. However, when things start going downhill, banks typically stop lending due to declining asset values, worsening the situation. Similarly, when the economy improves, asset values rise, and lending increases. Diamond and Dybvig developed a model showing how runs on banks can occur as a crisis begins and how policies such as deposit insurance can lessen the associated risk.

As Fed Chair during the financial crisis of 2007-08, Bernanke sought to reduce the accelerator role of banks as the economy struggled by implementing “quantitative easing” (QE). Essentially, QE floods the system with liquidity, encouraging banks to lend. The policy was controversial, but kept the situation from becoming much worse. Without that massive infusion, there was a genuine threat of global financial collapse. Some indicators (such as the “spread,” – the difference between the risk-free rate and what banks charge when lending to each other) were at alarming proportions (55 times the normal gap at one point) and could not have been sustained.

The work of these Nobel Memorial Prize winners helped us better understand how central banks should react during an economic crisis. While all policies can involve negative consequences, the Great Recession could have been far worse without their seminal contributions. Stay safe!

___________________________________________

Dr. M. Ray Perryman is President and Chief Executive Officer of The Perryman Group (www.perrymangroup.com), which has served the needs of more than 2,500 clients over the past four decades.