Texas Border Business

‘From San Antonio to El Paso, Longview to the Panhandle, and down to Laredo, small businesses have told me about the challenges they’re up against. They’ve been forced to make tough decisions about the future of their businesses and the livelihood of their employees.’

‘Senate Democrats blocked additional funding for this job-saving program because it didn’t include money for other relief funds, which are nowhere near being depleted.’

‘It’s time to provide more funding for the Paycheck Protection Program so we can ensure that once life goes back to normal, Texas will be open for business.’

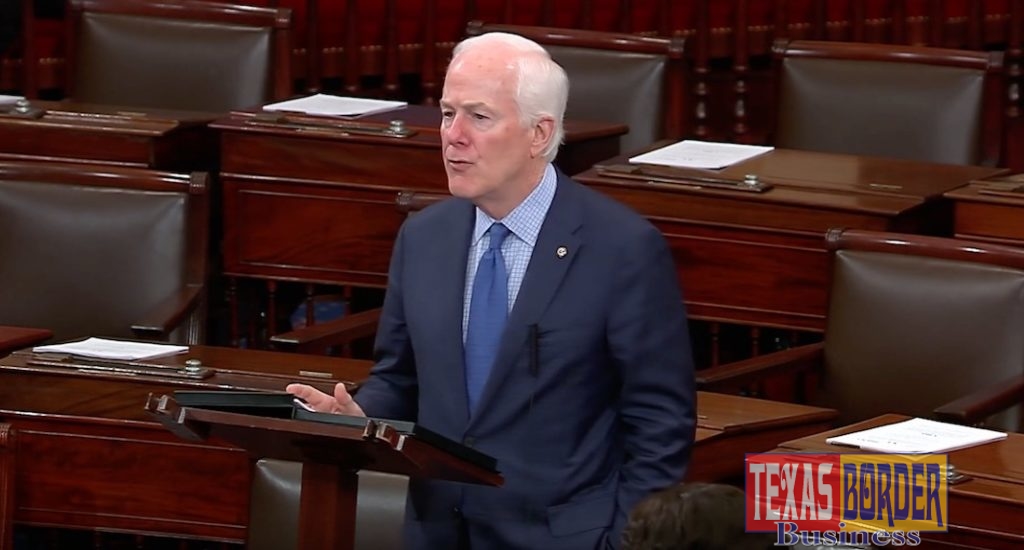

WASHINGTON — U.S. Senator John Cornyn (R-TX) authored the following op-ed in the San Antonio Express-News on the success of the Paycheck Protection Program established in the CARES Act and the need for additional funding to keep Texas small businesses afloat:

More Funding Needed to Protect Paychecks in Pandemic

Senator John Cornyn

San Antonio Express-News

April 15, 2020

As the number of confirmed COVID-19 cases in Texas continues to grow, we can’t help but ask, “when?” When will the outbreak peak? When will people go back to work? When will things return to “normal”?

This situation is unlike any our country has faced before — it combines the fear of a public health emergency with the uncertainty of an economic one.

The timeline to resume our routines largely depends on our ability to stop the spread of the virus, and provide our hospitals, health care professionals and first responders with the resources they need on the front lines. But it also involves throwing a lifeline to the people, businesses and institutions that define our own versions of normal so they can open their doors when this crisis ends.

Think about your favorite restaurant or the gym you visit a few times a week. There’s the flower shop you call before every wedding anniversary, the bookstore whose aisles you love to browse, and the barbershop you call when you need a haircut. At no fault of their own, these businesses have been forced to close their doors or dramatically shift operations to deal with the current circumstances. As a result, the businesses and employees our communities love and depend on are in jeopardy.

In late March, President Donald Trump signed the CARES Act — the third bill passed by Congress to bolster our nation’s response to the novel coronavirus. It provided hundreds of billions of dollars in funding for hospitals and local governments, and took bold steps to protect American jobs.

This legislation established the nearly $350 billion Paycheck Protection Program to keep businesses and their employees afloat. It provides loans to small businesses, which they can use to cover not only employee salaries and wages but also health care benefits, retirement contributions and paid sick leave. This assistance can also help with a business’s rent or mortgage payments, supply chain disruptions and utilities. Not only are these loans low interest, but employers can have certain portions of the loan forgiven if they maintain their payroll and don’t cut salaries.

Over the past several weeks, I’ve joined virtual meetings and conference calls with countless small business owners across the state. From San Antonio to El Paso, Longview to the Panhandle, and down to Laredo, small businesses have told me about the challenges they’re up against. They’ve been forced to make tough decisions about the future of their businesses and the livelihood of their employees. But the Paycheck Protection Program has provided a sense of hope and relief.

Unlike funding for hospitals and state and local governments, which have taken longer to prepare for distribution, the Paycheck Protection Program was ready to accept and approve applications in only two weeks. The more than 135 existing SBA-certified lenders in Texas — including local banks, credit unions and financial institutions, with more being added every day — can distribute these loans.

Unfortunately, whenever Congress passes substantive legislation this quickly, some things are bound to get overlooked. I have been working with Texans across the state to fill these gaps and get money flowing to all small-business owners in need, regardless of bureaucratic red tape.

In the first few days, it became clear that the overwhelming popularity of the program would quickly exceed the amount of money available. Now that we’ve tossed this lifeline to small businesses, we cannot reel it in until they’ve had a chance to grab on.

Senate Republicans recently introduced a bill to supplement this fund with more than $250 billion, bringing the total to $600 billion. The bill didn’t include any other proposals that could have slowed its passage — just money for the Paycheck Protection Program, plain and simple.

Unfortunately, the bill didn’t pass. Senate Democrats blocked additional funding for this job-saving program because it didn’t include money for other relief funds, which are nowhere near being depleted.

Returning our country to a sense of normalcy will require a departure from Congress’ normal behavior, too. There’s no time for partisanship or attempts to gain leverage. We all win, or we all lose.

It’s time to provide more funding for the Paycheck Protection Program so we can ensure that once life goes back to normal, Texas will be open for business.

Senator John Cornyn, a Republican from Texas, is a member of the Senate Finance, Intelligence, and Judiciary Committees.