Texas Border Business

Inflation can cause a recession if incomes and spending fall below the rate of price increases.

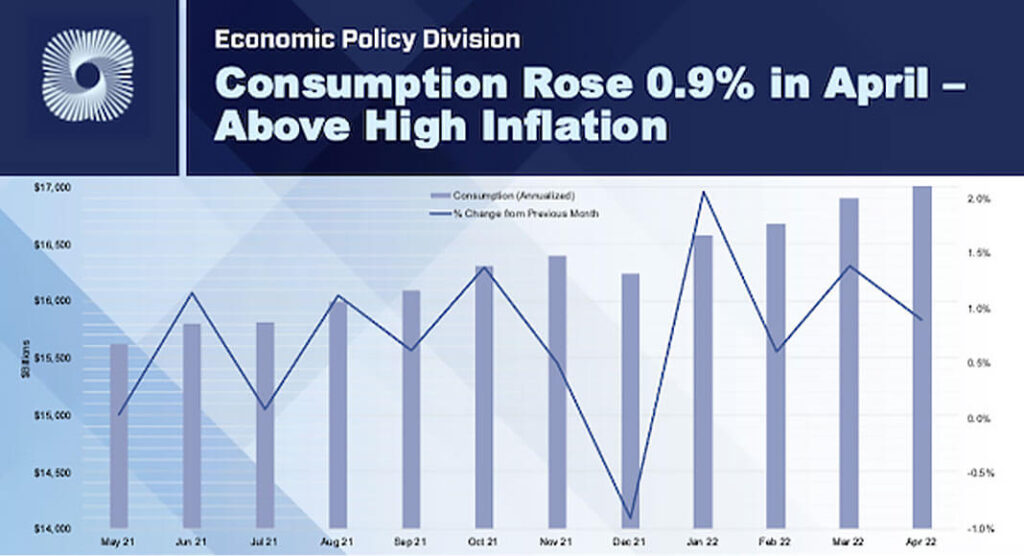

Why it matters: With the highest inflation we’ve had in decades, this is a real threat. However, American consumers keep spending above inflation, which is a hopeful sign we can avoid a recession in the near term.

By the numbers: According to the Bureau of Economic Analysis, in April:

- Inflation was up 0.2% from March and 6.3% annually

- Income rose 0.4% or 0.2% adjusted for inflation

- Wages and salaries rose 0.6%; 0.4% adjusted for inflation

- Spending rose 0.9%; 0.7% adjusted for inflation

- Savings fell almost 12%. The personal savings rate is the lowest in 13 years.

Be smart: Consumers can keep ahead of inflation because wages and salaries grew more than inflation and because they are spending down their savings.

- They can stay ahead of inflation for the next few months if wages continue to grow because they still have a reservoir of savings to draw from. Despite the savings rate dropping each month this year, there is still well over $2 trillion in excess savings from March of 2020 for consumers to spend down.

Bottom line: While this situation can’t last forever if high inflation persists, it can keep us out of recession for a while.

Go deeper:

—Curtis Dubay, Senior Economist, U.S. Chamber of Commerce