Texas Border Business

By Roberto Hugo González

Edward “Ted” James, the SBA Region 6 Administrator, was in high spirits when he recently visited Harlingen. The occasion? The 70th anniversary of the Small Business Administration (SBA), a milestone worth celebrating. Established on July 30 by President Eisenhower, the SBA has played an instrumental role in nurturing the ambitions of countless American entrepreneurs. James, representing Region 6, has been part of festivities spanning Texas, Louisiana, Arkansas, New Mexico, and Oklahoma. He wasn’t merely reminiscing about the past but was enthusiastically charting the roadmap for the next 70 years.

Texas proudly hosts six district offices under the SBA umbrella, a testament to the state’s vibrant entrepreneurial spirit and the pivotal role the SBA plays in fostering it. With Texas boasting more SBA district offices than any other state, Region 6 stands tall as the largest of the 10 SBA regions.

Over its illustrious 70-year journey, the SBA has made an indelible mark on small businesses, offering them robust support in their endeavors to start, grow, and expand. It also took charge in helping businesses recover from unforeseen challenges, be it natural disasters or economic downturns. The aftermath of the Covid-19 pandemic was no different. James revealed that in response to the pandemic, the SBA deployed a staggering $500 billion in Texas alone. This massive financial aid, coupled with the agency’s firm support, contributed to what can be described as a “small business boom”. Over a million small business applications have been filed in the past two years, highlighting the ever-increasing relevance and demand for SBA’s services.

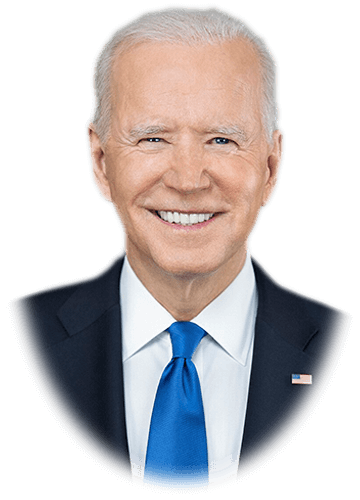

Underlining the multifaceted role of the SBA, James spoke about their initiatives to connect entrepreneurs with technical assistance, expand lending networks, and facilitate interactions between small businesses and the federal government. The agency’s efforts have been further bolstered by the Biden administration, with Administrator Isabella Casillas Guzman championing the cause of small businesses. The tangible results of this emphasis are evident in the $8 billion increase in contracts awarded to small businesses by the federal government.

In a climate of economic unpredictability, the SBA has emerged as a reliable beacon for businesses, especially with the challenges of high interest rates. James shed light on the impressive figures: just through the SBA’s 7(a) loan program, they’ve deployed about $13 billion this year, a figure that’s anticipated to rise to $16 billion by the end of the fiscal year. This underscores the trust small businesses place in the SBA, relying on their designated lenders to infuse capital and fuel their growth.

Regarding the ceiling for loans to small businesses, while specifics vary, the SBA’s commitment to tailoring solutions to the unique needs of each enterprise remains consistent. Entrepreneurs are encouraged to engage with district offices to identify the best loan programs suited to their aspirations and requirements.

For the Small Business Administration (SBA), supporting businesses is not just about providing funds; it’s about ensuring that these funds are channeled in the right direction. Elaborating on this point, the Region 6 Administrator, James, shared the various nuances of the loan programs the SBA offers. Their renowned 7(a) loan, for instance, offers a substantial ceiling of $5 million, making it an invaluable resource for businesses seeking working capital.

Diving into specifics, James highlighted the 504 programs, ideal for those who have their sights set on purchasing land or buildings. He underscored the flexibility and importance of the 7(a) loan, especially for businesses aiming for procurement opportunities that might require buying new equipment or recruiting more personnel.

Understanding the varied needs of businesses, the SBA has also instituted the Community Advantage loan. Tailored for mission-based lenders, this loan focuses on aiding communities of color and rural areas. Recognizing the significance of smaller loans in supporting grassroots entrepreneurship, the program offers a max loan limit of $350,000.

The aftermath of the pandemic caused chaos on many businesses. While giants in the industry had their resources to fall back on, small and medium-sized enterprises found themselves navigating insolvency. Addressing this concern, James drew attention to the SBA’s COVID Idle program, a variation of their long-standing Idle initiative. Designed specifically for the challenges of the pandemic, this program now aids businesses in transitioning to more traditional loan frameworks. For those struggling to repay these loans, the SBA offers a structured process to ensure these enterprises don’t default, but this requires proactive communication from the businesses.

James had a moving message for entrepreneurs of the Rio Grande Valley, “The SBA is here for you.” He emphasized the agency’s intent to serve as an accessible resource, mirroring the entrepreneurial spirit of the businesses they aid. Acknowledging challenges like language barriers, James proudly shared the SBA’s proactive measures to disseminate information in both English and Spanish. By collaborating with local authorities, including mayors passionate about nurturing their region’s business landscape, the SBA reaffirms its commitment to not just showing up, but being a consistent, dependable presence.

As James wrapped up the discussion, he shared a glimpse into his active schedule. Based out of Dallas, with frequent visits to the New Orleans office, James’ commitment takes him across various district offices in Region 6. His travels symbolize the SBA’s broader mission: to reach businesses wherever they are, ensuring they have the support and resources they need to thrive.

The 70-year SBA celebration event was sponsored by VtTX1 Internet and hosted by the Harlingen Chamber of Commerce and the Harlingen EDC