BY MIKE BLUM

As the managing partner of NAI Rio Grande Valley[1], I am often asked to provide an explanation about the unique nature of the Valley economy. This study is intended for that purpose.

If you left the Valley in 2008 and just returned you would only need to drive our new Interstate highway (I-2) from the west side of Mission to Brownsville to see that there has been explosive growth in the region and particularly in retail development along the corridor.

In that time frame JC Penny opened new stores in Mission, Edinburg and Weslaco. Costco opened in Pharr while Sam’s built its 2nd store in N. McAllen. Burlington Coats added stores in Edinburg, Weslaco and Harlingen. Academy expanded in McAllen, Edinburg, and Weslaco. The Bass Pro Shop in Harlingen continues to attract other retailers to the area, including Sam’s Club recently opened. La Paloma Power Plant’s, a 690 megawatt natural gas-fired plant to be constructed beginning in 2014 on the eastern edge of Harlingen.

So what has this meant to the cities along the corridor?

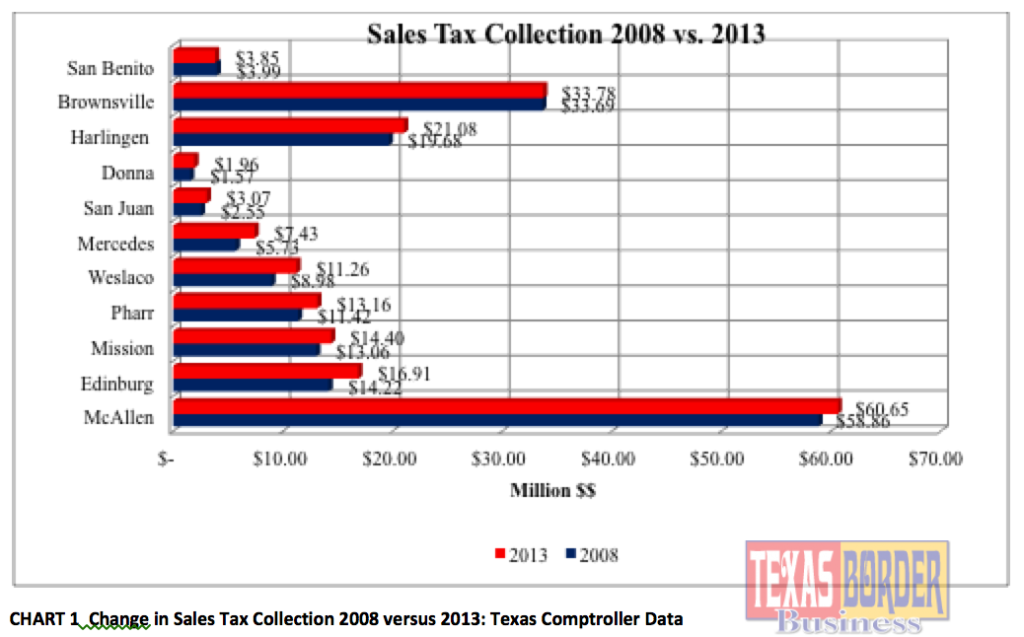

Chart I below examines the growth in retail sales tax revenue among these selected cities. It is undeniable that McAllen, with over $60 million in sales tax collection in 2013, remains the retail center of the Rio Grande Valley. Its growth from 2008, while only 3%, is confirmation that the worst of the recession has passed and retail has returned.

The economic recovery is obviously all across the Valley; Brownsville is showing improvement with sales tax collections higher than 2008, their previous best year. All the other cities in Hidalgo and Cameron County have had considerable growth in their sales tax revenues with the exception of San Benito. This growth in sales tax collections generally goes directly to property tax reductions and increased investment in public infrastructure.

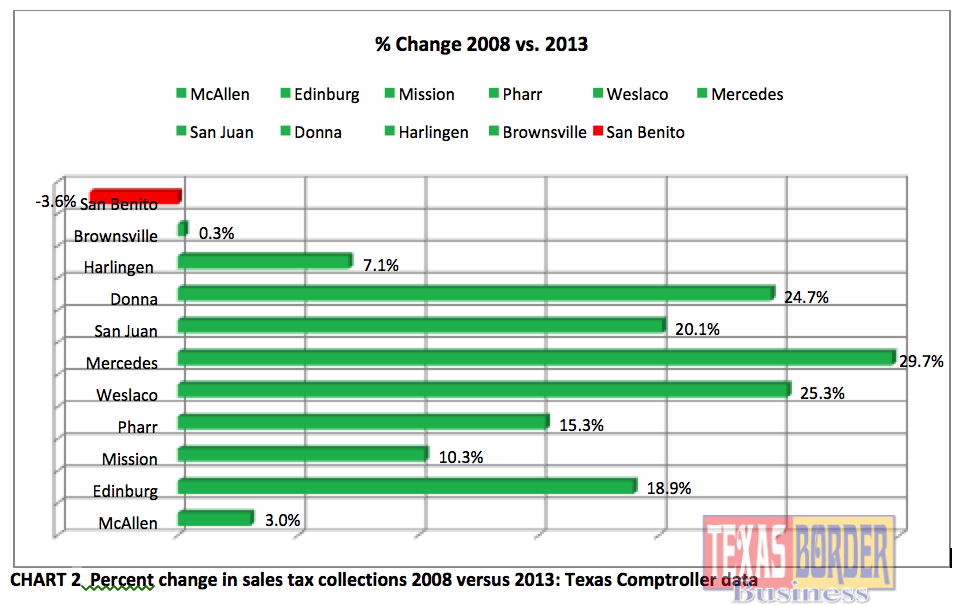

CHART 1 Change in Sales Tax Collection 2008 versus 2013: Texas Comptroller Data

Chart 2 shows the percent change in sales tax collections among the same cities between 2008 and 2013. Mercedes is the leader among these cities in percent increase over 2008, which is due in part to a number of new stores at the Premium Outlet center. 400 Shops is an amazing collection of retail venues. Weslaco’s dramatic increase is due in part to the new retail cluster anchored by JC Penny and Academy. Pharr’s increase is arguably do to the addition of Costco, the nearby cluster of restaurants.

CHART 2 Percent change in sales tax collections 2008 versus 2013: Texas Comptroller data

Mexican shoppers historically were the primary reason why McAllen had the dominant share of the retail pie. And with the increase of IVA tax in Mexico border cities, this may indeed return as its market share reduces. There is another component that has a material influence on McAllen stability and market dominance: The hospitality sector and specifically hotels.

Hotel Rooms 2nd Qt 2013 | ||

City | Rooms | % of Total |

McAllen | 3,400 | 31.1% |

Edinburg | 589 | 5.4% |

Mission | 624 | 5.7% |

Pharr | 1,072 | 9.8% |

Weslaco | 756 | 6.9% |

Mercedes | 115 | 1.1% |

San Juan | 238 | 2.2% |

Donna | 262 | 2.4% |

Harlingen | 1,282 | 11.7% |

Brownsville | 2,411 | 22.0% |

San Benito | 196 | 1.8% |

TOTAL | 10,945 | 100.0% |

Table 1 Texas Comptroller Data

Table 1 shows the total number of hotel rooms in the selected cities in the 2nd quarter of 2013. McAllen has over 3,400 hotel rooms. If each room was occupied 365 days a year, that’s the equivalent of 1.2 million people, if there was only one person to a room. If the hotel occupancy rate was 50% that computes to 744,000 people who don’t live in McAllen but are here eating and shopping and effectively adding to the economy. That’s a major influx of people that keep McAllen’s cash registers ringing.

So…now that you understand a little about what has happened to the Valley over the past 5 years, start to ponder what the future holds and how each city with act or react to the changes before them?

[1] Michael J. Blum is a Partner and Managing Broker of NAI Rio Grande Valley, an affiliate of NAI Global, the single largest and most powerful worldwide network of owner-operated commercial real estate brokerage firms. He is also a distinguished Texas Border Business Guest Writer.