Texas Border Business

Sen. Cornyn voted for the CARES Act in the Senate on Wednesday, and the House of Representatives will soon pass it and send it to the President’s desk for his signature.

“With both the physical and economic health of our country in crisis, this bold legislation is our best path forward,” said Sen. Cornyn.

How the CARES Act helps Texans:

- Aids the health care industry responding to the pandemic:

- Provides an additional $100 billion for hospitals

- Provides $11 billion for vaccines, therapeutics, diagnostics, and other medical needs

- Provides $1.5 billion in support for local, state, and federal public health agencies

- Opens up telehealth access for home-based services, community health centers, and rural health centers and provides an additional $1.3 billion for community health centers to treat COVID-19 patients

- Provides direct and immediate financial relief to Texans:

- Allots $1,200 checks to each Texan making less than $75,000 annually ($2,400 for a couple making less than $150,000 annually), plus $500 per child

- Allows Texans to access their retirement plans for coronavirus-related expenses without an early withdrawal penalty

- Allows Texans to defer student loan payments for 6 months with no penalty or interest

- Incentivizes charitable giving by temporarily increasing the amount Texans can deduct from their taxes for charitable contributions, and allows

- Expands unemployment insurance (UI) for Texas workers:

- Provides an extra $600 weekly federal UI benefit on top of the state maximum temporarily

- Funds an additional 13 weeks of federally-funded unemployment eligibility for individuals after they’ve exhausted state UI benefits through the end of the year

- Temporarily expands UI eligibility to include the self-employed, independent contractors, those with limited work history, railroad workers, and those who worked at non-profit entities

- Injects targeted funding to state and local entities:

- $150 billion for state and local governments, allotted based on population (any city or county with more than 500,000 residents can petition the U.S. treasury directly for funding)

- $272 billion in targeted funding for state and local assistance, including:

- State, local, and tribal governments

- Hospitals and health care workers

- Law enforcement and first responders

- Scientists researching treatments and vaccines

- Small businesses struggling to pay their employees

- Local schools and universities

- Affordable housing and homelessness assistance programs

- The purchase of personal protective equipment (PPE) and medical equipment

- Offers relief for Texas businesses:

- Provides $500 billion in secured loans to affected businesses and establishes an Inspector General and Oversight Board to provide accountability for the loan program

- Provides $350 billion for SBA interruption loans

- Provides bankruptcy relief for Texas small businesses by raising the maximum debt threshold for eligibility, so that more small- and medium-sized businesses can get through bankruptcy faster and more easily

- Delays the employer payroll tax

- Increases the amount of deductible business interest allowed

- Offers a Temporary Employer Retention Credit for certain businesses

- Temporarily freezes the Employer Student Loan Repayment

- Allows SBA loan forgiveness for mortgage payments, payroll, and utility payments

- Suspends aviation excise taxes through 2020; provides $32 billion in payroll assistance grants for airlines like those based in Texas and supporting industries

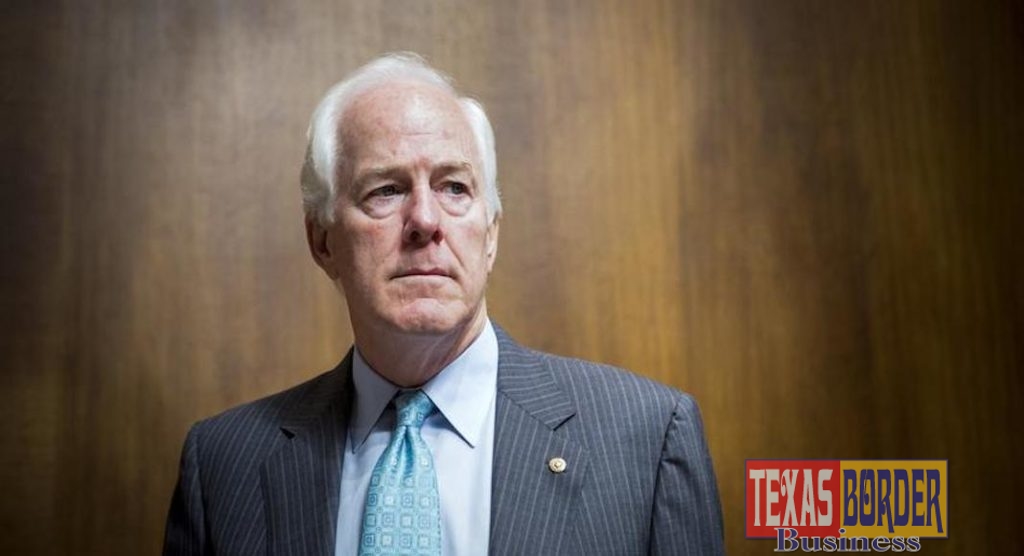

Senator John Cornyn, a Republican from Texas, is a member of the Senate Finance, Intelligence, and Judiciary Committees.