Texas Border Business

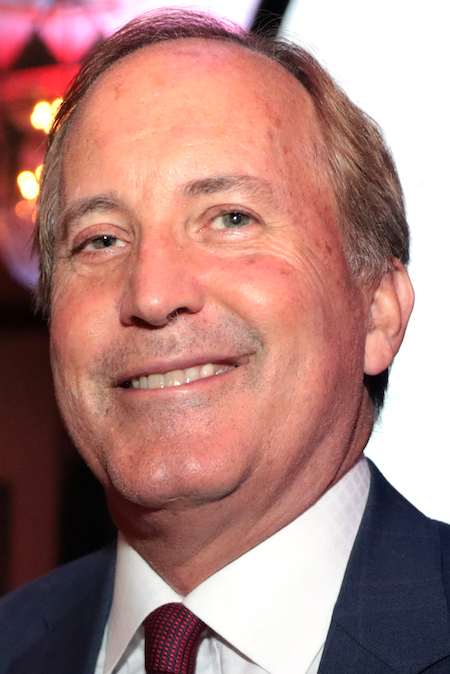

Attorney General Ken Paxton, as part of an 18-state coalition, sued the U.S. Securities and Exchange Commission (“SEC”) and members of the Biden-Harris Administration for unlawfully promulgating sweeping new regulations on cryptocurrencies without any legal authority.

The Administration’s recent rules aim to force digital asset platforms to register with the SEC as securities exchanges, dealers, brokers, and clearinghouses, and to comply with the requirements of federal securities laws—despite not being contemplated at all by the statutory text. The SEC claims such regulations are authorized by the Securities Act of 1933 and Exchange Act of 1934, however, these nearly century-old laws in no way contemplate digital assets such as cryptocurrencies or give a federal agency the power to override the authority of the States to legislate on the topic. Further, the SEC’s regulations constitute unlawful ultra viresactions and violate the Administrative Procedure Act.

“Federal bureaucrats in Washington have no authority to dictate to States how they should interact with cryptocurrency, nor do they have the power to crush this new field with a regulatory framework that Congress never intended,” said Attorney General Paxton.

The filing explained: “Instead of respecting that constitutional balance of power, and allowing States to develop and enforce their own tailored digital asset regulations based on their own policy priorities (furthering their constitutional role as laboratories of democracy), the SEC’s assertion of sweeping jurisdiction without congressional authorization deprives States of their proper sovereign role and chills the development of innovative regulatory frameworks for the digital asset industry. Still worse, by attempting to shoehorn digital assets into ill-fitting federal securities laws and inapt disclosure regimes, the SEC is harming the very citizens it purports to protect, by displacing better-suited state laws that have been carefully designed to ensure consumer protection in the digital asset industry.”

To read the filing, click here.